Find the most affordable medical insurance rates in the state of Washington. Easily compare multiple companies that offer the lowest prices for individuals, families and small business owners. The Washington Healthplanfinder was created by the State Health Benefit Exchange and the Affordable Care Act legislation to make it easier to review low cost options and quickly enroll online for coverage. More than 200,000 persons enrolled last year. Twelve insurers offer under 65-coverage, and free standardized Silver-tier plans are offered qualified child-care workers.

Open Enrollment begins November 1st and continues to January 15th. However, Washington Apple Health (Medicaid) and Medicare for persons age 65 and over, have different qualifying periods. Senior Medigap coverage is offered through Supplement and Advantage plans that can often pay for many expenses not covered by original Medicare. Also, it is possible for one spouse to be covered under a Marketplace plan, while the other spouse has a combination of Medicare and Medigap benefits. Part D prescription drug plans are also offered to Seniors.

Special Enrollment Periods (SEP) are available throughout the year with an approved exception. For example, if you lose qualified benefits from an employer, move to a different service area, reach age 26 while covered on a parent’s plan, get divorced, or become pregnant, a qualifying life event has been created. However, non-compliant short-term plans may be purchased throughout the entire year, subject to policy provisions and restrictions.

Typically, the Northwest features some of the most favorable prices for healthcare. Premiums offered by the major companies are usually very budget-friendly even though “Basic Health” is no longer available for households whose income (before taxes) is below 200% of the Federal Income Guidelines. Instead, a combination of subsidized Marketplace plans and Medicaid eligibility policies provide many low-cost choices.

Prices will not be the same in all parts of the state. For example, individual premiums in Seattle or Spokane will not be identical to rates in Yakima or Tacoma. The proximity of hospitals and physicians, and the effectiveness of their treatment, will affect what you pay. Naturally, we find the most competitive offers from all of the “big players.” And since prices change so often, we update the best options daily. Non-Obamacare plans are also available.

What Is The Washington Health Marketplace?

The Washington Healthplanfinder offers coverage to individuals and families (you can still view rates and apply on our website). Comprehensive, catastrophic, HSA, and high-deductible policies are offered on a single or family basis. You can view the best prices later in this article or by utilizing our quote box. Small businesses are also eligible to apply for a policy through a special “SHOP” Exchange.

You can purchase plans with the help of a federal subsidy (if you qualify), or choose to enroll in an “off-Marketplace” plan, that does not use federal funding to pay any of the premium. Both types of policies are not medically-underwritten, so you can not be turned down because of past, present, or potential future conditions. Consumers can report changes, upload documents, and obtain financial assistance. Payments can also be submitted online.

Participating Insurers

The 12 Marketplace companies in Washington are BridgeSpan, Coordinated Care, Community Health Network Of Washington, Kaiser Foundation Health Plan Of Washington, Kaiser Foundation Health Plan Of The Northwest, LifeWise, Molina, PacificSource Health Plans, Premera Blue Cross, Regence BCBS Of Oregon, Regence BlueShield, and UnitedHealthcare Of Oregon. Each carrier offers individual and family plans that are available through the Marketplace and approved by the Washington Department of Insurance. A brief synopsis each company is provided below. Note: Asuris Northwest Health, Providence Health Plan, and Health Alliance NW will offer off-Exchange plans.

Standardized plans are available by all on-Exchange carriers. The Cascade Care public option plans are available from all carriers that offer coverage through Healthplanfinder, and ACA benefits are included. All counties in the state will have two (or more) participating insurers. A public option was previously offered in these 22 counties: Adams, Asotin, Benton, Chelan, Clallam, Cowlitz, Douglas, Garfield, Grant, Jefferson, King, Kitsap, Kittitias, Klickitat, Lewis, Lincoln, Mason, Okanogan, Pierce, Spokane, Whitman, and Yakima. Additional counties have been recently added. A study has been initiated to research the impact of offering Cascade plans (only) in 2025. During last year’s Special Enrollment, 40% of all customers chose a Cascade plan.

Thanks to the Affordable Care Act, you don’t have to medically qualify for any of the plans, and federal subsidies can reduce the premium (if you meet income eligibility requirements). However, as your income changes, it’s important to recalculate your financial subsidy. Significant differences in income from one year to another could result in large rate increases or decreases. There are 120 available plans offered (2 Catastrophic, 52 Bronze, 33 Silver, 33 Gold, and 0 Platinum). Carriers offering the most plans are Regence BlueShield (21) and Coordinated Care (18). Carriers offering the least plans are Community Health Network (3), UnitedHealthcare (6), and Molina (6).

Washington Health Plans And Rates By Region

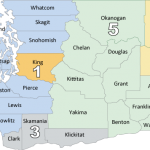

Washington’s Five Healthcare Regions

The state is divided into five regions, which determine the specific carriers that offer “on-Exchange” policies and the participating counties where they are available. We have outlined each of the five counties below:

Region 1 – King County. Available companies include Coordinated Care, Kaiser Foundation Healthcare Of Washington, Molina, and Premera Blue Cross.

Region 2 – Counties of Clallam, Jefferson, Mason, Whatcom, Skagit, Pierce, Lewis, Grays Harbor, Kitsap, Thurston, Pacific, Cowlitz, San Juan, Island, Wahkiakum, and Snohomish. Available companies include Coordinated Care, Kaiser Foundation Health Plan Of Washington, Kaiser Foundation Health Plan Of The Northwest, Molina, Premera Blue Cross, and LifeWise.

Region 3 – Counties of Clark, Skamania and Klickitat. Available companies include BridegeSpan, Kaiser Foundation Health Plan Of The Northwest, LifeWise, Molina, and Premera Blue Cross.

Region 4 – Counties of Ferry, Stevens, Lincoln, Spokane, and Pend Oreille. Available companies include Kaiser Foundation Health Plan Of Washington, Coordinated Care, LifeWise, Molina, and Premera Blue Cross.

Region 5 – Counties of Yakima, Benton, Douglas, Grant, Franklin, Adams, Columbia, Okanogan, Chelan, Kittitas, Walla Walla, Asotin, Garfield, and Whitman. Available companies include Asuris, BridgeSpan, Coordinated Care, Lifewise, Health Alliance Northwest, Kaiser Foundation Health Plan Of Washington, Molina, and Premera Blue Cross.

Individual Companies Offering Policies

Asuris Northwest Health – No Exchange plans are offered. Non-Exchange plans are available in the following counties: Adams, Asotin, Benton, Chelan, Columbia, Douglas, Ferry, Franklin, Garfield, Grant, Kittitas, Lincoln, Okanogan, Pend Oreille, Spokane, Stevens, Walla Walla, and Whitman.

Premera Blue Cross is the Pacific Northwest’s biggest healthcare provider, insuring individuals, families, and businesses. More than two million persons are covered under medical, dental, vision, disability, life or other ancillary products. Most customers live in Washington, Oregon, or Alaska. Medicare Supplement coverage is available to Seniors, and all policyholders can choose from a provider network of more than 35,000 doctors, hospitals, and other facilities. Under-65 plans are available in Franklin, Grays Harbor, King, Kitsap, Pacific, Pierce, Spokane, and Yakima Counties. Coverage is no longer offered in Wahkiakum and Skamania Counties.

Regence BlueCross BlueShield Of Oregon offers plans in Clark County. Rates moderately increased this year. Plans are offered in Washington, Oregon, Utah, and Idaho.

Regence BlueShield offers plans in 20 counties. Regence serves the Mountain/Pacific Northwest region and covers more than 3 million persons.

Community Health Network (CHNW) slightly increased their 2024 rates. For 30 years, plans have been offered in specific areas of the state. The last three years, coverage increased from 9 counties to 26 counties. Cascade Select plans are a popular option for many state residents.

Affordable Washington Health Insurance Plans

Coordinated Care covers about 200,000 persons in the state. The parent company is Centenne Corporation, who offers plans under the brand name “Ambetter” in many states. Often, their prices are very competitively-priced. Washington Apple Health plan (low-income adults) and Apple Health Core Connections (children and young adults) are also offered. Coverage is available in 35 counties. Rates slightly increased this year.

Plans are offered in the following Counties: Adams, Asotin, Benton, Chelan, Columbia, Douglas, Franklin, Garfield, Grant, Jefferson, King, Kitsap, Kittitas, Klickitat, Lewis, Lincoln, Mason, Okanogan, Pacific, Pend Oreille, Pierce, Snohomish, Spokane, Stevens, Thurston, Walla Walla, Whitman, and Yakima.

Molina offers integrated Medicare and Medicaid coverage, along with Marketplace plans in many states. Rates are generally attractive, and several plan choices are offered. Two Bronze, Silver, and Gold plans are often available. Copays are typically offered on most office visits. Coverage is offered in 19 counties.

Bridgespan is affiliated with Cambia Health Solutions and offers coverage in Washington, Utah, Idaho, and Oregon. Member satisfaction is typically high, and several ancillary dental and vision products are offered. Several Bronze-tier plans are available.

Kaiser Foundation Health Plan is the biggest nonprofit healthcare organization in the US. Although many of their customers are located in the West, they still cover more than 8 million persons. States that they service include Washington, Virginia, Oregon, California, Colorado, Maryland, Hawaii, Georgia, Ohio, and the District of Columbia. Based in Oakland, Kaiser was founded more than 70 years ago, and also consists of many hospitals, and the for-profit Permanente Medical Groups. Rates substantially increased this year, and plans are offered in Clark and Cowlitz Counties.

PacificSource Health Plans is a nonprofit insurer that offers plans throughout the Northwest. More than 300,000 persons are covered with 90,000 doctors, hospitals, and other providers available. Healthcare, dental, FSAs, and HRAs are offered. Coverage is available in four counties.

UnitedHealthcare, one of the nation’s largest carriers, offers plans in Allen, Clallam, Jefferson, King, Kittitas, Lincoln, Mason, Pierce, Whitman, and Yakima Counties. Short-term plans (non-Obamacare) plans are also available.

Community Health Network Of Washington was created in 1992 as a non-profit managed care company. Approximately 300,000 persons are covered through existing plans. 2024 rates increased by approximately 2.5%. Plans are offered in 26 counties.

LifeWise Health Plan Of Washington prides itself on great customer service and a vast network of more than 15,000 doctors and facilities. The conglomerate of companies provides coverage for more than 2 million persons in Alaska and Washington. Many plans are available, and the service area has increased to 35 counties since Wahkiakum and Skamania Counties have been added.

NOTE: Approximately 250,000 persons do not have group benefits provided by an employer, or government-provided coverage, such as Medicaid or CHIP. More than 200,000 persons typically enroll in the Exchange, and more than half of these applicants qualify for a federal subsidy. If household income changes, the amount of the provided subsidy is also likely to increase or decrease. All Marketplace tiers are eligible for financial aid except “catastrophic” plans, which are offered to applicants under age 30. Although copays for primary care office visits are low, often a deductible is placed on specialist office visits.

Also, the federal mandate requiring the purchase of “qualified” healthcare ended last year. Previously, the tax penalty could be as high as 2.5% of the household income. Any lapse in coverage resulted in a prorated penalty, based on the number of months that members were uninsured. The penalty was applied the following year when federal taxes were filed. There is no discussion that the penalty will be reinstated.

2024 Requested Rate Changes For Washington Marketplace Plans

Asuris Northwest Health – 3.32% decrease (Asuris Direct EPO)

BridgeSpan – 14.49% increase (BridgeSpan Exchange EPO No Ped Dental)

Community Health Plan Of Washington – 2.50% increase (Cascade Select)

Coordinated Care Corporation – 4.80% increase (Ambetter Essential Care)

Kaiser Foundation (Washington) – 17.77% increase (GHC I&F Core Basics Plus Catastrophic, GHC Individual And Family Flex Bronze, GHC individual And Family Core HSA Exchange, and GHC Individual And Family Flex Bronze)

Kaiser Foundation (Northwest) – 7.44% increase (Base Medical With Vision Exam, Base Medical, Base Medical With Vision Exam And Pedi Dental, Base Medical With Pedi Dental, and WA Standard Plans)

Molina – 6.49% increase (Molina Healthcare)

PacificSource Health Plans – 8.50% increase (PPO With Pediatric Without Adult Vision and PPO Without Pediatric Dental And Adult Vision)

Premera Blue Cross – 17.35% increase (Preferred HSA EPO and Preferred EPO)

Providence Health Plan – 4.69% increase (Columbia Individual)

Regence BCBS Of Oregon – 6.17% increase (Regence Direct EPO and Regence Exchange EPO)

UnitedHealthcare – 0.39% decrease (UHC IND EPO)

The Exchange

The Washington Health Insurance Exchange (Marketplace) started accepting applications six years ago. (When you request quotes on our website, you will be able to view your options). Close to a half of a million persons applied for coverage. Senate Bill 5445 created the establishment of the program, which is designed to offer affordable medical plans to all residents, regardless of income. The program is also referred to as the “Healthplanfinder.”

There is no required medical underwriting since it is community-rating based. Your age, zip code and smoking status are the principal criteria to determine pricing. Also, subsidies (in the form of instant tax credits) can potentially reduce your premium by as much as 100%! Prices decreased for many plans. The average reduction is about 3%.

Most Affordable Washington State Health Insurance Plans

Catastrophic Tier

Kaiser Basic Catastrophic – $9,450 deductible with $9,450 maximum out-of-pocket expenses and 0% coinsurance. First three pcp office visits are covered at 100%.

Bronze Tier

Molina Cascade Bronze – $6,000 deductible with $9,200 maximum out-of-pocket expenses and 40% coinsurance. $50 and $100 (specialist visits must meet deductible) office visit copays with $100 Urgent Care copay. $32 generic drug copay ($80 mail order).

BridgeSpan Cascade Bronze – $6,000 deductible with $9,200 maximum out-of-pocket expenses and 40% coinsurance. $50 (no deductible on pcp visits and $0 copay for first two) and $100 office visit copays with $100 Urgent Care copay. $32 generic and preferred generic drug copays ($96 mail order).

BridgeSpan Bronze Essential 7500 – $8,500 deductible with $9,450 maximum out-of-pocket expenses and 10% coinsurance. $60 office visit copays (subject to deductible). $60 Urgent Care copay. $20 generic drug copay.

Ambetter Cascade Select Bronze (Coordinated Care) – $6,000 deductible with $9,200 maximum out-of-pocket expenses and 40% coinsurance. $50 ($1 first two visits) and $100 office visit copays and $100 Urgent Care copay. $32 generic drug copay ($80 mail order).

Ambetter Essential Care 1(Coordinated Care) – $9,000 deductible with $9,000 maximum out-of-pocket expenses and 0% coinsurance. $3 and $25 preferred generic and generic drug copays ($7.50 and $62.50 mail order).

Ambetter Cascade Bronze (Coordinated Care) – $6,000 deductible with $9,200 maximum out-of-pocket expenses and 40% coinsurance. $50 ($1 first two visits) and $100 office visit copays and $100 Urgent Care copay. $32 generic drug copay ($80 mail order).

Ambetter Essential Care: $0 Medical Deductible – $0 deductible with $9,250 maximum out-of-pocket expenses and 50% coinsurance. $45 and $115 office visit copays and $60 Urgent Care copay. $3 and $35 preferred generic and generic drug copays ($7.50 and $87.50 mail order). $60 copay for lab services.

Kaiser Virtual Plus Bronze – $8,700 deductible with $8,700 maximum out-of-pocket expenses and 0% coinsurance. $50 and $110 office visit copays. No charge for telehealth visits. $110 Urgent Care copay. Preferred generic drug copay is $30 ($15 mail order).

Kaiser Cascade Bronze – $6,000 deductible with $8,550 maximum out-of-pocket expenses and 40% coinsurance. $50 (no deductible) and $100 office visit copays. No charge for telehealth visits. $100 Urgent Care copay. Preferred generic drug copay is $32 ($27 mail order).

Kaiser Flex Bronze – $5,500 deductible with $8,900 maximum out-of-pocket expenses and 20% coinsurance. Preferred generic drug copay is $25 ($20 mail order).

Premera Blue Cross Preferred Bronze EPO 6350 – $6,350 deductible with $8,200 maximum out-of-pocket expenses and 40% coinsurance. $50 pcp office visit copay ($0 first two visits). Preferred generic drug copay is $30 ($90 mail order).

Premera Blue Cross Cascade Bronze – $6,000 deductible with $8,550 maximum out-of-pocket expenses and 40% coinsurance. $50 and $100 office visit copays and $100 Urgent Care copay. Preferred generic drug copay is $32 ($96 mail order).

LifeWise Essential Bronze – $6,400 deductible with $8,600 maximum out-of-pocket expenses and 35% coinsurance. $50 and $100 office visit copays. Preferred generic drug copay is $32 ($96 mail order).

LifeWise Cascade Bronze – $6,000 deductible with $8,500 maximum out-of-pocket expenses and 40% coinsurance. $50 and $100 office visit copays. Freestanding center Urgent Care has a $100 copay. Preferred generic drug copay is $32 ($96 mail order).

LifeWise Essential Bronze HSA – HSA-eligible plan with $6,200 deductible with $7,000 maximum out-of-pocket expenses and 40% coinsurance.

Regence BlueShield Bronze Care On Demand 8500 – $8,500 deductible with $9,100 maximum out-of-pocket expenses and 20% coinsurance. $15 generic drug copay.

Providence Connect 9000 Bronze – $9,000 deductible with $9,000 maximum out-of-pocket expenses and 0% coinsurance. $60 and $80 office visit copays and $80 Urgent Care copay. Tier 1 and Tier 2 drug copays are $0 and $35.

PacificSource Navigator Bronze HSA 7050 – HSA-eligible plan with $7,050 deductible with $7,050 maximum out-of-pocket expenses and 0% coinsurance.

PacificSource Navigator Bronze 9100 – $9,100 deductible with $9,100 maximum out-of-pocket expenses and 0% coinsurance. $35 pcp office visit copay. $35 Urgent Care copay.

Community Health Network Of Washington Cascade Select Bronze – $6,000 deductible with $8,550 maximum out-of-pocket expenses and 40% coinsurance. $50 and $100 office visit copays and $100 Urgent Care copay. Generic drug copay is $32 ($86 mail order).

UnitedHealthcare Bronze Value+ – $8,400 deductible with $9,100 maximum out-of-pocket expenses and 50% coinsurance. $0 pcp office visit copay and $75 Urgent Care copay. Tier 1 drug copay is $20. $30 lab test copay.

Silver Tier

Ambetter Balanced Care 4 (Coordinated Care) – $7,550 deductible with $7,550 maximum out-of-pocket expenses and 0% coinsurance. Office visit copays are $30 and $60. The Urgent Care copay is $60. Generic and preferred brand drug copays are $5 and $50.

Ambetter Cascade Silver (Coordinated Care) – $2,500 deductible with $8,500 maximum out-of-pocket expenses and 30% coinsurance. Office visit copays are $30 and $65. The Urgent Care copay is $65. Generic and preferred brand drug copays are $25 and $75. The non-preferred brand drug copay is $250. Diagnostic test (lab and x-ray) copays are $40 and $65.

Ambetter Cascade Select Silver (Coordinated Care) – $2,500 deductible with $8,500 maximum out-of-pocket expenses and 30% coinsurance. Office visit copays are $30 and $65. The Urgent Care copay is $65. Generic and preferred brand drug copays are $25 and $75. The non-preferred brand drug copay is $250. Diagnostic test (lab and x-ray) copays are $40 and $65.

Molina Cascade Silver 250 Plan – $2,500 deductible with $8,500 maximum out-of-pocket expenses and 30% coinsurance. Office visit copays are $30 and $65. The Urgent Care copay is $65. Diagnostic testing copays are $40 (blood work) and $65 (x-rays). Generic and preferred brand drug copays are $25 and $75.

Molina Constant Care Silver 1 250 Plan – $0 deductible with $7,300 maximum out-of-pocket expenses. Office visit copays are $30 and $60. The Urgent Care copay is $30. Diagnostic testing copays are $60 (blood work) and $95 (x-rays). Generic and preferred brand drug copays are $25 and $60.

LifeWise Essential Silver Low Deductible – $2,875 deductible with $8,375 maximum out-of-pocket expenses and 30% coinsurance. Office visit copays are $30 and $65. Preferred generic drug copays are $20 and $60 (mail order). Urgent Care copay is $55 at freestanding facilities.

Kaiser Cascade Silver – $2,500 deductible with $8,500 maximum out-of-pocket expenses and 30% coinsurance. Office visit copays are $30 and $65. The preferred generic and preferred brand drug copays are $25 and $75. Urgent Care copay is $65. Lab and x-ray copays are $40 and $65.

Kaiser Virtual Plus Silver – $3,000 deductible with $9,000 maximum out-of-pocket expenses and 30% coinsurance. Office visit copays are $20 and $40. No charge for telehealth visits. Preferred generic drug copay is $20. Urgent Care copay is $40.

BridgeSpan Cascade Select Silver – $2,500 deductible with $8,500 maximum out-of-pocket expenses and 30% coinsurance. $30 and $65 office visit copays and $65 urgent Care copay. Preferred generic, generic, preferred brand, and brand drug copays are $25, $25, $75, and $250 ($75, $75, $225, and $750 mail order). X-ray and lab test copays are $65 and $40.

Premera Blue Cross Preferred Silver EPO 4300 – $4,300 deductible with $8,700 maximum out-of-pocket expenses and 30% coinsurance. $25 and $60 office visit copays and $60 Urgent Care copay at freestanding facility. Preferred generic drug copays are $25 ($75 mail order). $65 and $40 copays for lab tests and x-rays.

Regence Cascade Silver – $2,500 deductible with $8,500 maximum out-of-pocket expenses and 30% coinsurance. $30 and $65 office visit copays and $65 Urgent Care copay. Generic drug copay is $25 ($75 mail order). Preferred brand drug copay is $75 ($225 mail order). $65 and $40 copays for lab tests and x-rays.

UnitedHealthcare Cascade Silver – $2,500 deductible with $8,500 maximum out-of-pocket expenses and 30% coinsurance. $25 and $75 office visit copays and $65 Urgent Care copay. Tier 1 and Tier 2 drug copays are $25 and $75. Blood work and x-ray copays are $40 and $65.

UnitedHealthcare Silver Advantage – $0 deductible with $9,100 maximum out-of-pocket expenses and 30% coinsurance. $0 and $75 office visit copays and $75 Urgent Care copay. Tier 1 and Tier 2 drug copays are $15 and $85. Blood work and x-ray copays are $40 and $50.

Community Health Network Of Washington Cascade Select Silver – $2,000 deductible with $7,800 maximum out-of-pocket expenses and 30% coinsurance. $25 and $60 office visit copays and $60 Urgent Care copay. Generic drug copay is $20 ($54 mail order). Preferred brand drug copay is $70 ($189 mail order). Blood work and x-ray copays are $35 and $60.

PacificSource Navigator Silver 5000 – $5,000 deductible with $5,750 maximum out-of-pocket expenses and 30% coinsurance. $15 and $30 office visit copays and $15 Urgent Care copay.

Gold Tier

Ambetter Secure Care 20 (Coordinated Care) – $750 deductible with $7,500 maximum out-of-pocket expenses and 35% coinsurance. $35 and $55 office visit copays. $35 Urgent Care copay. Generic and preferred brand drug copays are $5/$15 and $60. $35 copay for diagnostic tests.

Ambetter Secure Care 5 (Coordinated Care) – $1,450 deductible with $6,300 maximum out-of-pocket expenses and 20% coinsurance. Office visit copays are $15 and $35. The Urgent Care copay is $35. Generic and preferred brand drug copays are $5/$15 and $30. Outpatient lab tests have a $15 copay.

Kaiser Flex Gold – $1,150 deductible with $7,900 maximum out-of-pocket expenses and 30% coinsurance. Office visit copays are $20 and $45. The Urgent Care copay is $45. Preferred generic drug copays are $10 and $5, and preferred brand drug copays are $40 and $35.

Kaiser Cascade Gold – $500 deductible with $5,250 maximum out-of-pocket expenses and 20% coinsurance. Office visit copays are $15 and $40. The Urgent Care copay is $35. Preferred generic drug copays are $10 and $5, and preferred brand drug copays are $60 and $55. Non-preferred drug copays are $100 and $95. Diagnostic lab and x-ray copays are $20 and $30.

LifeWise Essential Gold – $1,000 deductible with $7,000 maximum out-of-pocket expenses and 30% coinsurance. Office visit copays are $30 and $55. Urgent Care copay is $55. The preferred generic drug copays are $10 and $30. ER copay is $250.

Molina Choice Gold – $2,925 deductible with $6,500 maximum out-of-pocket expenses and 20% coinsurance. Office visit copays are $10 and $50. The Urgent Care copay is $10. Tier 1 and Tier 2 drug copays are $10 and $50. $15 copay for blood work.

Community Health Network Of Washington Cascade Select Gold – $500 deductible with $5,250 maximum out-of-pocket expenses and 20% coinsurance. $15 and $40 office visit copays and $35 Urgent Care copay. Generic drug copay is $10 ($27 mail order). Preferred brand drug copay is $60 ($162 mail order). Blood work and x-ray copays are $20 and $30. Imaging copay is $300.

BridgeSpan Cascade Gold – $500 deductible with $5,2500 maximum out-of-pocket expenses and 20% coinsurance. $15 and $40 office visit copays and $35 urgent Care copay. Preferred generic/generic, preferred brand, and brand drug copays are $10, $60, and $100 ($20, $120, and $200 mail order). X-ray and lab test copays are $30 and $20.

PacificSource Navigator Gold 2000 – $2,000 deductible with $5,500 maximum out-of-pocket expenses and 20% coinsurance. $20 and $40 office visit copays and $20 Urgent Care copay. Tier 1 and Tier 2 drug copays are $15 and $70 ($30 and $210 mail order).

UnitedHealthcare Cascade Gold Value+ – $1,500 deductible with $7,500 maximum out-of-pocket expenses and 30% coinsurance. Office visit copays are $30 and $50. The Urgent Care copay is $50. Tier 1 and Tier 2 drug copays are $5 and $50. The non-preferred brand drug copay is $100. $20 copay for blood work.

Sample Monthly Rates

30 Year-Old Residing in Seattle (King County) With $33,000 Income

$20 – Kaiser Virtual Plus Bronze 22

$24 – Kaiser Bronze 22

$31 – Kaiser Bronze HSA 22

$32 – Ambetter Essential Care 1

$38 – Kaiser Cascade Bronze

30 Year-Old Married Couple Residing in Seattle (King County) With $52,000 Income

$65 – Kaiser Virtual Plus Bronze 22

$73 – Kaiser Bronze 22

$88 – Kaiser Bronze HSA 22

$89 – Ambetter Essential Care 1

$100 – Kaiser Cascade Bronze

45 Year-Old Residing in Spokane (Spokane County) With $38,000 Income

$80 – Ambetter Essential Care 1

$92 – Community Health Cascade Select Bronze

$94 – Ambetter Cascade Select Bronze

$98 – Ambetter Cascade Bronze

$113 – Bridgespan Bronze Care On Demand 8000

45 Year-Old Married Couple Residing in Spokane (Spokane County) With $52,000 Income

$52 – Ambetter Essential Care 1

$76 – Community Health Cascade Select Bronze

$80 – Ambetter Cascade Select Bronze

$88 – Ambetter Cascade Bronze

$118 – Bridgespan Bronze Care On Demand 8000

55 Year-Old Residing in Tacoma (Pierce County) With $45,000 Income

$181 – BridgeSpan Bronze Care On Demand 8000 Exchange EPO MultiCare Connected Care

$204 – BridgeSpan Bronze Essential 7500 Exchange EPO MultiCare Connected Care

$216 – BridgeSpan Bronze HDHP 6000 Exchange EPO MultiCare Connected Care

$223 – Ambetter Essential Care 2

$353 – Ambetter Balanced Care 4

55 Year-Old Married Couple Residing in Tacoma (Pierce County) With $67,000 Income

$175 – BridgeSpan Bronze Care On Demand 8000 Exchange EPO MultiCare Connected Care

$220 – BridgeSpan Bronze Essential 7500 Exchange EPO MultiCare Connected Care

$245 – BridgeSpan Bronze HDHP 6000 Exchange EPO MultiCare Connected Care

$260 – Ambetter Essential Care 2

$519 – Ambetter Balanced Care 4

History of Obamacare In The Evergreen State

Nine carriers had said they were going to participate in the original Healthplanfinder. Bridgespan and Premera Blue Cross were two of a handful of companies that had submitted their prices for the Exchange. Preliminary monthly rates were approximately $220 for a 21-year old and $600 for a 60-year old. Of course, the federal subsidy was not included in those prices, and rates subsequently reduced for most applicants.

The Washington Health Benefit Exchange Board discussed, reviewed and approved seven companies that offered consumers coverage beginning in 2014. Prices and other specific details were electronically entered in a database that were able to be viewed in October (2013).

The seven approved companies for the inaugural year were BridgeSpan, Premera Blue Cross, Group Health Cooperative, Kaiser, LifeWise of Washington, Community and Molina. They offered between 30 and 40 plans on the Marketplace. Coordinated Care became the eighth approved company. Kaiser Health Plans are also extensively covered on our website.

It’s unclear how each of these carriers will continue to handle illegal immigrants in the state. “Apple Health” (Medicaid) (see below) will cover women who are pregnant and any child between the ages of 0 and 17. For some legal immigrants that don’t speak English fluently, it will be a challenge to understand Enrollment procedures. However, steps are being taken to help, including hiring many staff members that can speak and understand Spanish.

As plans and benefits (and prices) change, we will keep you updated. Currently, there are many affordable individual and family policies available. We make it easy for you to compare and apply for coverage. Providing your zip code is the first step.

Washington Temporary Health Insurance

Policies are issued through LifeMap Assurance Company. Daily rates are shown below:

Male $1,000 Deductible

Ages 0-19 – 3.88

Ages 20-24 – 3.18

Ages 25-29 – 3.61

Ages 30-34 – 4.47

Ages 35-39 – 5.55

Ages 40-44 – 7.11

Ages 45-49 – 9.31

Ages 50-54 – 12.52

Ages 55-59 – 16.65

Female $1,000 Deductible

Ages 0-19 – 4.02

Ages 20-24 – 4.97

Ages 25-29 – 6.41

Ages 30-34 – 7.69

Ages 35-39 -8.78

Ages 40-44 – 10.12

Ages 45-49 – 11.86

Ages 50-54 – 14.09

Ages 55-59 – 16.38

Senior Washington Medigap Coverage

Medicare Supplement

Standardized Supplement plans help persons that have reached age 65, cover many out-of-pocket expenses, including hospital coinsurance, deductible, hospice coinsurance (Part A) and coinsurance or copay, deductible, and excess charges (Part B). Illustrated below are current monthly rates (Age 65 and older) for popular Medicare Supplement plans from several major carriers:

Plan A

$140 – AARP-UnitedHealthcare

$156 – Humana

$170 – Regence BS

$171 – United American

$173 – Cigna

$173 – Elips Life

$180 – United World Life

$183 – United Of Omaha

$209 – GPM Health

$335 – Sentinel Security

Plan B

$207 – AARP-UnitedHealthcare

$244 – United American

$373 – Sentinel Security

Plan C

$239 – Regence BS

$244 – AARP-UnitedHealthcare

$275 – United American

$461 – Sentinel Security

Plan D

$261 – United American

$398 – Sentinel Security

Plan F (High Deductible)

$44 – United American

$49 – Globe

$67 – Humana

$70 – United Of Omaha

Plan F

$216 – Transamerica

$225 – Asuris Northwest Health

$225 – Regence Blue Shield

$227 – First Health Life

$228 – USAA

$229 – Humana

$231 – Globe Life

$232 – Regence BCBS

$242 – UnitedHealthcare

$264 – State Farm

$265 – Garden State Life

$266 – Loyal American

$288 – United American

$296 – Colonial Penn

Plan G (High Deductible)

$44 – United American

$52 – Premera Blue Cross

$54 – Globe Life

$54 – United Of Omaha

$61 – Garden State Life

$67 – Humana

$72 – Colonial Penn

Plan G

$169 – State Farm

$180 – USAA

$182 – Garden State Life

$185 – Humana

$188 – Asuris Northwest Health

$188 – Regence BCBS

$194 – Premera Blue Cross

$200 – UnitedHealthcare

$211 – First Health Life

$220 – Transamerica

$221 – United Of Omaha

$222 – United American

Plan K

$60 – AARP-UnitedHeathcare

$84 – Kaiser

$96 – Colonial Penn

$98 – Transamerica

$115 – Regence Blue Shield

$117 – Asuris Northwest Health

Plan L

$134 – AARP-UnitedHealthcare

$145 – Transamerica

$165 – Colonial Penn

Plan N

$124 – State Farm

$129 – USAA

$133 – Loyal American

$135 – Kaiser

$140 – Humana

$140 – Mutual Of Omaha

$142 – Aetna

$145 – Asuris Northwest Health

$155 – AARP-UnitedHealthcare

$157 – First Health Life

$162 – Colonial Penn

$166 – Globe Life

$168 – Transamerica

$176 – Premera Blue Cross

Medicare Part D Prescription Drug Plans In Washington

Prescription drugs from Medicare can be obtained from an Advantage plan or a stand-alone Part B plan. Each policy has a list of covered drugs (Formulary), which are placed into different “tiers.” The lower the tier, the lower are your out-of-pocket expenses. Shown below are options for the state of Washington. Prices can change each year. If a change is made to the formulary, and you are actively taking the prescription, 60 days advance notice must be provided.

AARP UnitedHealthcare Medicare Rx Walgreens – Monthly premium of $48.80 with $410 deductible. Tier 1 preferred 30-day and 90-day cost-sharing copays are $2 and $6. Tier 2 preferred 30-day and 90-day cost-sharing copays are $8 and $24. Tier 3 preferred 30-day and 90-day cost-sharing copays are $40 and $120. 3,253 formulary drugs available. 3.0 Summary Star Rating.

AARP UnitedHealthcare Medicare Rx Basic from UHC – Monthly premium of $39.70 with $545 deductible. Tier 1 preferred 30-day and 90-day cost-sharing copays are $2 and $6. Tier 2 preferred 30-day and 90-day cost-sharing copays are $8 and $24. Tier 3 preferred 30-day and 90-day cost-sharing copays are 16%. 3,009 formulary drugs available. 3.0 Summary Star Rating.

AARP UnitedHealthcare Medicare Rx Preferred– Monthly premium of $98.40 with $0 deductible. Tier 1 preferred 30-day and 90-day cost-sharing copays are $7 and $21. Tier 2 preferred 30-day and 90-day cost-sharing copays are $12 and $36. Tier 3 preferred 30-day and 90-day cost-sharing copays are $47 and $141. 3,622 formulary drugs available. 3.5 Summary Star Rating.

Asuris Medicare Script Basic – Monthly premium of $84.00 with $455 deductible. Tier 1 preferred 30-day and 90-day cost-sharing copays are $3 and $9. Tier 2 preferred 30-day and 90-day cost-sharing copays are $13 and $39. Tier 3 preferred 30-day and 90-day cost-sharing copays are $40 and $120. 2,939 formulary drugs available.

Asuris Medicare Script Enhanced – Monthly premium of $113.00 with $0 deductible. Tier 1 preferred 30-day and 90-day cost-sharing copays are $3 and $6. Tier 2 preferred 30-day and 90-day cost-sharing copays are $10 and $20. Tier 3 preferred 30-day and 90-day cost-sharing copays are $47 and $117.50. 3,483 formulary drugs available.

Cigna Secure Rx – Monthly premium of $38.70 with $505 deductible. Tier 1 preferred 30-day and 90-day cost-sharing copays are $1 and $3. Tier 2 preferred 30-day and 90-day cost-sharing copays are $5 and $15. Tier 3 preferred 30-day and 90-day cost-sharing copays are $26 and $78. 3,185 formulary drugs available.

Cigna Extra Rx – Monthly premium of $54.70 with $100 deductible. Tier 1 preferred 30-day and 90-day cost-sharing copays are $4 and $12. Tier 2 preferred 30-day and 90-day cost-sharing copays are $10 and $30. Tier 3 preferred 30-day and 90-day cost-sharing copays are $45 and $135. 3,363 formulary drugs available.

Cigna Saver Rx – Monthly premium of $12.30 with $505 deductible. Tier 1 preferred 30-day and 90-day cost-sharing copays are $0 and $0. Tier 2 preferred 30-day and 90-day cost-sharing copays are $10 and $30. Tier 3 preferred 30-day and 90-day cost-sharing copays are $40 and $120. 3,308 formulary drugs available.

Clear Spring Health Premier Rx – Monthly premium of $22.60 with $505 deductible. Tier 1 preferred 30-day and 90-day cost-sharing copays are $1 and $3. Tier 2 preferred 30-day and 90-day cost-sharing copays are $5 and $15. Tier 3 preferred 30-day and 90-day cost-sharing copays are $42 and $126. 3,178 formulary drugs available.

Clear Spring Health Value Rx – Monthly premium of $28.50 with $505 deductible. Tier 1 preferred 30-day and 90-day cost-sharing copays are $1 and $3. Tier 2 preferred 30-day and 90-day cost-sharing copays are $3 and $9. Tier 3 preferred 30-day and 90-day cost-sharing copays are $42 and $126. 3,133 formulary drugs available.

Elixir RXPlus – Monthly premium of $20.30 with $480 deductible. Tier 1 preferred 30-day and 90-day cost-sharing copays are $1 and $3. Tier 2 preferred 30-day and 90-day cost-sharing copays are $6 and $18. Tier 3 preferred 30-day and 90-day cost-sharing copays are $43 and $129. 3,157 formulary drugs available.

Elixir RxSecure – Monthly premium of $37.60 with $480 deductible. Tier 1 preferred 30-day and 90-day cost-sharing copays are $1 and $3. Tier 2 preferred 30-day and 90-day cost-sharing copays are $4 and $12. Tier 3 preferred 30-day and 90-day cost-sharing copays are 15% and 15%. 3,085 formulary drugs available.

Humana Walmart Value Rx Plan – Monthly premium of $22.70 with $480 deductible. Tier 1 preferred 30-day and 90-day cost-sharing copays are $1 and $3. Tier 2 preferred 30-day and 90-day cost-sharing copays are $4 and $12. Tier 3 preferred 30-day and 90-day cost-sharing copays are 16% and 16%. 3,221 formulary drugs available.

Humana Premier Rx Plan – Monthly premium of $75.30 with $480 deductible. Tier 1 preferred 30-day and 90-day cost-sharing copays are $1 and $3. Tier 2 preferred 30-day and 90-day cost-sharing copays are $4 and $12. Tier 3 preferred 30-day and 90-day cost-sharing copays are $45 and $135. 3,281 formulary drugs available.

Humana Basic Rx Plan – Monthly premium of $38.20 with $480 deductible. Tier 1 preferred 30-day and 90-day cost-sharing copays are $0 and $0. Tier 2 preferred 30-day and 90-day cost-sharing copays are $1 and $3. Tier 3 preferred 30-day and 90-day cost-sharing copays are both 19%. 3,104 formulary drugs available.

Mutual Of Omaha Rx Premier – Monthly premium of $31.40 with $480 deductible. Tier 1 preferred 30-day and 90-day cost-sharing copays are $0 and $0. Tier 2 preferred 30-day and 90-day cost-sharing copays are $13 and $39. Tier 3 preferred 30-day and 90-day cost-sharing copays are 23% and 23%. 3,018 formulary drugs available.

Mutual Of Omaha Rx Plus – Monthly premium of $99.90 with $480 deductible. Tier 1 preferred 30-day and 90-day cost-sharing copays are $1 and $3. Tier 2 preferred 30-day and 90-day cost-sharing copays are $3 and $9. Tier 3 preferred 30-day and 90-day cost-sharing copays are 16% and 16%. 2,970 formulary drugs available.

SilverScript Choice – Monthly premium of $31.30 with $260 deductible. Tier 1 preferred 30-day and 90-day cost-sharing copays are $0 and $0. Tier 2 preferred 30-day and 90-day cost-sharing copays are $5 and $15. Tier 3 preferred 30-day and 90-day cost-sharing copays are $35 and $105. 3,091 formulary drugs available.

SilverScript Plus – Monthly premium of $75.00 with $0 deductible. Tier 1 preferred 30-day and 90-day cost-sharing copays are $0 and $0. Tier 2 preferred 30-day and 90-day cost-sharing copays are $2 and $0. Tier 3 preferred 30-day and 90-day cost-sharing copays are $47 and $120. 3,150 formulary drugs available.

SilverScript SmartRx – Monthly premium of $6.30 with $445 deductible. Tier 1 preferred 30-day and 90-day cost-sharing copays are $0 and $0. Tier 2 preferred 30-day and 90-day cost-sharing copays are $19 and $57. Tier 3 preferred 30-day and 90-day cost-sharing copays are $46 and $138. 3,652 formulary drugs available.

WellCare Classic – Monthly premium of $30.50 with $445 deductible. Tier 1 preferred 30-day and 90-day cost-sharing copays are $0 and $0. Tier 2 preferred 30-day and 90-day cost-sharing copays are $1 and $3. Tier 3 preferred 30-day and 90-day cost-sharing copays are $25 and $75.

WellCare Wellness Rx – Monthly premium of $17.20 with $445 deductible. Tier 1 preferred 30-day and 90-day cost-sharing copays are $0 and $0. Tier 2 preferred 30-day and 90-day cost-sharing copays are $5 and $15. Tier 3 preferred 30-day and 90-day cost-sharing copays are $40 and $120.

WellCare Value Script – Monthly premium of $18.70 with $445 deductible. Tier 1 preferred 30-day and 90-day cost-sharing copays are $0 and $0. Tier 2 preferred 30-day and 90-day cost-sharing copays are $4 and $12. Tier 3 preferred 30-day and 90-day cost-sharing copays are $43 and $129.

WellCare Medicare Rx Select – Monthly premium of $24.50 with $445 deductible. Tier 1 preferred 30-day and 90-day cost-sharing copays are $0 and $0. Tier 2 preferred 30-day and 90-day cost-sharing copays are $3 and $9. Tier 3 preferred 30-day and 90-day cost-sharing copays are $47 and $141.

WellCare Medicare Rx Saver – Monthly premium of $33.50 with $445 deductible. Tier 1 preferred 30-day and 90-day cost-sharing copays are $0 and $0. Tier 2 preferred 30-day and 90-day cost-sharing copays are $2 and $6. Tier 3 preferred 30-day and 90-day cost-sharing copays are $35 and $105.

WellCare Medicare Value Plus – Monthly premium of $71.90 with $0 deductible. Tier 1 preferred 30-day and 90-day cost-sharing copays are $1 and $3. Tier 2 preferred 30-day and 90-day cost-sharing copays are $4 and $12. Tier 3 preferred 30-day and 90-day cost-sharing copays are $47 and $141.

Medicare Advantage Plans

Rates, deductibles, copays, benefits, and plan availability can vary by county of residence.

AARP Medicare Advantage Plan 1 – $86 monthly premium with $0 deductible. Preferred generic, generic, and preferred brand prescription drug copays are $0, $12, and $45. Office visit copays are $0 and $25. Inpatient and outpatient hospital copays are $250 for 7 days and $0-$245. Occupational, physical, speech, and language therapy visit copays are $25. Outpatient group and individual mental health visit therapy copays are $5 and $10. The ground ambulance copay is $250.

AARP Medicare Advantage Plan 2 – $0 monthly premium with $0 deductible. Preferred generic, generic, and preferred brand prescription drug copays are $0, $12, and $47. Office visit copays are $0 and $45. Inpatient and outpatient hospital copays are $390 for 5 days and $0-$385. Occupational, physical, speech, and language therapy visit copays are $30. Outpatient group and individual mental health visit therapy copays are $5 and $10. The ground ambulance copay is $250.

AARP Medicare Advantage Plan 3 – $43 monthly premium with $0 deductible. Preferred generic, generic, and preferred brand prescription drug copays are $0, $12, and $45. Office visit copays are $0 and $30. Inpatient and outpatient hospital copays are $375 for 4 days and $0-$370. Occupational, physical, speech, and language therapy visit copays are $30. Outpatient group and individual mental health visit therapy copays are $5 and $10. The ground ambulance copay is $250.

AARP Medicare Advantage Choice Plan – $19 monthly premium with $0 deductible. Preferred generic, generic, and preferred brand prescription drug copays are $0, $12, and $45. Office visit copays are $0 and $45. Inpatient and outpatient hospital copays are $390 for 5 days and $0-$350. Occupational, physical, speech, and language therapy visit copays are $30. Outpatient group and individual mental health visit therapy copays are $30-$40. The ground ambulance copay is $240.

AARP Medicare Advantage Walgreens – $0 monthly premium with $0 deductible. Preferred generic, generic, and preferred brand prescription drug copays are $0, $0, and $47. Office visit copays are $0 and $30. Inpatient and outpatient hospital copays are $390 for 4 days and $0-$325. Occupational, physical, speech, and language therapy visit copays are $20. Outpatient group and individual mental health visit therapy copays are $5 and $10. The ground ambulance copay is $240.

Aetna Medicare Value Plan – $0 monthly premium with $0 deductible. Preferred generic, generic, and preferred brand prescription drug copays are $0, $10, and $47. Office visit copays are $10 and $50. Inpatient and outpatient hospital copays are $475 for 4 days and $0-$350. Occupational, physical, speech, and language therapy visit copays are $40. Outpatient group and individual mental health visit therapy copays are $40.

Aetna Medicare Value Plus Plan – $0 monthly premium with $0 deductible. Preferred generic, generic, and preferred brand prescription drug copays are $0, $10, and $47. Office visit copays are $0 and $45. Inpatient and outpatient hospital copays are $430 for 4 days and $0-$295. Occupational, physical, speech, and language therapy visit copays are $20. Outpatient group and individual mental health visit therapy copays are $40.

Aetna Medicare Elite Plan – $0 monthly premium with $0 deductible. Preferred generic, generic, and preferred brand prescription drug copays are $0, $5, and $47. Office visit copays are $0 and $35. Inpatient and outpatient hospital copays are $430 for 4 days and $0-$345. Occupational, physical, speech, and language therapy visit copays are $10. Outpatient group and individual mental health visit therapy copays are $40.

Aetna Medicare Platinum Plus Plan – $37 monthly premium with $0 deductible. Preferred generic, generic, and preferred brand prescription drug copays are $0, $0, and $47. Office visit copays are $0 and $35. Inpatient and outpatient hospital copays are $365 for 4 days and $0-$275. Occupational, physical, speech, and language therapy visit copays are $10. Outpatient group and individual mental health visit therapy copays are $40.

Aetna Medicare Platinum Select Plan – $99 monthly premium with $0 deductible. Preferred generic, generic, and preferred brand prescription drug copays are $0, $0, and $47. Office visit copays are $0 and $40. Inpatient and outpatient hospital copays are $295 for 4 days and $0-$295. Occupational, physical, speech, and language therapy visit copays are $20. Outpatient group and individual mental health visit therapy copays are $40.

Amerivantage Classic – $0 monthly premium with $0 deductible. Preferred generic, generic, and preferred brand prescription drug copays are $5, $15, and $42. Office visit copays are $0 and $45. Inpatient and outpatient hospital copays are $395 for 4 days and $0-$395. Occupational, physical, speech, and language therapy visit copays are $40. Outpatient group and individual mental health visit therapy copays are $40.

Community HealthFirst MA Extra Plan – $32 monthly premium with $0 deductible. Preferred generic, generic, and preferred brand prescription drug copays are $0, $10, and $42. Office visit copays are $10 and $45. Inpatient and outpatient hospital copays are $450 for 4 days and 20%.

Community HealthFirst MA Value Plan – $0 monthly premium with $0 deductible. Preferred generic, generic, and preferred brand prescription drug copays are $0, $10, and $42. Office visit copays are $15 and $50. Inpatient and outpatient hospital copays are $465 for 4 days and 20%.

Community HealthFirst MA Pharmacy Plan – $68 monthly premium with $0 deductible. Preferred generic, generic, and preferred brand prescription drug copays are $0, $10, and $42. Office visit copays are $0 and $40. Inpatient and outpatient hospital copays are $450 for 4 days and 20%.

Humana Gold Plus – $0 monthly premium with $100 deductible. Preferred generic, generic, and preferred brand prescription drug copays are $2, $8, and $47. Office visit copays are $0 and $50. Inpatient and outpatient hospital copays are $450 for 4 days and $5-$450.

Kaiser Permanente Medicare Advantage Key – $100 monthly premium with $0 deductible. Preferred generic, generic, and preferred brand prescription drug copays are $5, $15, and $45. Office visit copays are $10 and $50. Inpatient and outpatient hospital copays are $400 for 4 days and $300.

Kaiser Permanente Medicare Advantage Vital – $28 monthly premium with $0 deductible. Preferred generic, generic, and preferred brand prescription drug copays are $3, $7, and $45. Office visit copays are $5 and $35. Inpatient and outpatient hospital copays are $295 for 6 days and $250.

Kaiser Permanente Medicare Advantage Essential – $99 monthly premium with $0 deductible. Preferred generic, generic, and preferred brand prescription drug copays are $3, $7, and $45. Office visit copays are $10 and $35. Inpatient and outpatient hospital copays are $215 for 4 days and $200.

Kaiser Permanente Medicare Advantage Optimal – $295 monthly premium with $0 deductible. Preferred generic, generic, and preferred brand prescription drug copays are $3, $7, and $45. Office visit copays are $10 and $20. Inpatient and outpatient hospital copays are $125 for 2 days and $100.

Premera Blue Cross Medicare Advantage – $0 monthly premium with $300 deductible. Preferred generic, generic, and preferred brand prescription drug copays are $4, $12, and $42. Office visit copays are $15 and $45. Inpatient and outpatient hospital copays are $450 for 4 days and 20%.

Premera Blue Cross Medicare Advantage Core – $12 monthly premium with $300 deductible. Preferred generic, generic, and preferred brand prescription drug copays are $4, $12, and $42. Office visit copays are $15 and $45. Inpatient and outpatient hospital copays are $450 for 4 days and 20%.

Premera Blue Cross Medicare Advantage Sound + RX – $40 monthly premium with $160 deductible. Preferred generic, generic, and preferred brand prescription drug copays are $2, $12, and $42. Office visit copays are $10 and $50. Inpatient and outpatient hospital copays are $595 for 3 days and $495.

Premera Blue Cross Medicare Advantage Peak + RX – $0 monthly premium with $160 deductible. Preferred generic, generic, and preferred brand prescription drug copays are $2, $12, and $42. Office visit copays are $15 and $50. Inpatient and outpatient hospital copays are $595 for 3 days and 20%.

Premera Blue Cross Medicare Advantage Classic – $55 monthly premium with $180 deductible. Preferred generic, generic, and preferred brand prescription drug copays are $2, $10, and $40. Office visit copays are $5 and $30. Inpatient and outpatient hospital copays are $450 for 4 days and $350.

Regence MedAdvantage+ Rx Primary – $19 monthly premium with $300 deductible. Preferred generic, generic, and preferred brand prescription drug copays are $3, $13, and $40. Office visit copays are $15 and $45. Inpatient and outpatient hospital copays are $400 for 4 days and $45 or 20%.

Soundpath Health Peak + Rx – $0 monthly premium with $160 deductible. Preferred generic, generic, and preferred brand prescription drug copays are $3, $14, and $47. Office visit copays are $15 and $50. Inpatient and outpatient hospital copays are $595 for 3 days and $45 or 20%.

What Is Washington Apple Health?

Apple Health is the State Medicaid program that is available at any time throughout the year. You do not have to wait for the Open Enrollment period. Qualification is based upon your household income and your citizenship and state residency status, if applicable. You do not have to apply in person, since you can apply online here. Typically, the process takes less than an hour. Eligibility applicants must be between ages 19 and 64, a US citizen, not be currently incarcerated, and also not Medicare-qualified. The maximum monthly income allowed for a single person is approximately $1,317.

After you sign up for coverage, a comprehensive booklet is sent, which includes specific benefit information, including how to prepare for the first visit to your primary-care physician. A “ProviderOne” ID card shows your unique policy number and when the coverage was effective. Generally, each year, you must re-renew. Benefits will start on the first day of the month that your enrollment application was submitted.

The six available plans that are offered through Apple Health are Columbia United Providers, Molina Healthcare, UnitedHealthcare Community Plan, Amerigroup, Community Health Plan of Washington, and Coordinated Care Corporation.

Washington State Health Insurance Pool (WSHIP)

WSHIP is the state’s high-risk pool that was established more than 10 years ago. It was created for non-Medicare and Medicare applicants that could not qualify for standard healthcare coverage. With the passage of the Affordable Care Act, no new enrollments (under-65) have been processed since 2014, and only a small number of persons remain covered under the program. Monthly premiums are typically substantially more expensive than subsidized ACA plans. Monthly nonsmoker rates ($3,000 deductible) for King County are shown below.

Age 25 – $505

Age 35 – $614

Age 45 – $726

Age 55 – $1,121

Age 60 – $1,365

Dental Coverage For Children

You can purchase private affordable individual and family dental plans (off-Marketplace) from several major companies including UnitedHealthcare, Nationwide, IHC, and AlwaysCare. Monthly premiums typically range from $20-$70 per month. Waiting periods and annual maximum benefits will apply.

Qualified pediatric dental coverage is also available (Washington Healthplanfinder). Both federal and state mandates have been met. We have summarized below several of the best options:

Delta Dental Of Washington Kids Plan – Offered in all counties. $75 deductible and $350 out-of-pocket maximum. $0 copay for exams. Estimated monthly cost – $37.

Dental Health Services FirstSmile Early Care – Offered in 29 Western Counties with no deductible and a $350 out-of-pocket maximum. The copay is $10 and the estimated monthly rate is $26.

Dental Health Services FirstSmile Early Care Plus – Similar to prior plan with $3 copay (instead of $10) and premium of $30 (instead of $26).

Kaiser Permanente KP WA Pediatric Dental 100 – Only available in Cowlitz and Clark Counties.$50 deductible and $350 maximum out-of-pocket maximum. No charge for exams. Monthly rate is $30.

Lifewise Individual Pediatric Dental – Available in all counties. $65 deductible with maximum $350 out-of-pocket maximum. 10% coinsurance on exams. Monthly rate is $27.

Premera Blue Cross Individual Pediatric Dental – Offered in all counties except Clark. Same basic benefits and price as previous plan.

Dental Coverage For Adults

Dental Health Services SmartSmile – No deductible. $7 copay for exams and $25 copay for cleanings and x-rays. $47-$65 copay for filling a cavity and $325 copay for root canal. Approximate monthly premium of $18-$20.

Dental Health Services Super SmartSmile – No deductible. $5 copay for exams and $10 copay for cleanings. No copay for x-rays. $25-$47 copay for filling a cavity and $350 copay for root canal. Approximate monthly premium of $24-$27.

Dental Health Services SmartSmile Plus – No deductible. $5 copay for exams and $10 copay for cleanings. No copay for x-rays. $25-$47 copay for filling a cavity and $325 copay for root canal. Approximate monthly premium of $24-$27. Similar to previous plan, but with lower copays for nitrous oxide ($40 vs. $20) and gum treatment ($70 vs. $45).

Delta Dental Family Essential Plus – $50 deductible with $1,000 maximum yearly benefit. Exams, cleanings, fluoride, sealants, and x-rays covered at 100%. Coinsurance is 50%. Approximate monthly premium of $38-$42.

Dentegra Dental PPO Family Basic Plan – $50 deductible with $1,000 maximum yearly benefit. Routine care covered at 100% after deductible has been met. Restorative care covered at 50% after deductible has been met. Approximate monthly premium of $26-$30.

Washington Healthplanfinder For Small Businesses

Kaiser and Moda are the two exclusive companies offering coverage. Between 15 and 25 plans are offered to employers who can earn a potential 50% tax credit on Marketplace premiums they pay for their employees. Owners can determine the carrier, plan and coverage that is offered to their workers. Unlike the enrollment period for private plans, small employers can enroll all 12 months of the year.

There are several different types of plan choices. For example, you can choose a single policy that will be utilized by all employees. Also available is an “Employee Choice” option that provides multiple options with specified benefits and costs. This type of policy is popular when workers have various types of needs (ie high-deductible low-premium vs. more expensive no-deductible).

Other advantages of the Healthplanfinder Business tool are the easy comparison between products, flexible billing options, and quick and efficient sign-up and termination of coverage. Rates are typically very competitive with private policies offered on and off the Exchange.

State Of Washington Health Plan Filings

PAST UPDATES:

More than 200 new plans have been filed for the Washington Healthplanfinder Marketplace. The average rate hike is just above 8 percent, although there are wider variations, depending on the carrier and area of the state.

Both in and outside-Exchange plans were submitted for approval which should give consumers a wide choice of policies to choose from during Open Enrollment later in the year. It typically takes about two months for rate proposals to be studied and approved (or disapproved).

Time Insurance (Assurant) had the largest price increase request at 26% followed by Group Health Options at 14.2%. UnitedHealthcare is one of three new carriers requesting admission.

15 companies have filed requests to offer plans on (and off) the Washington Health Insurance Exchange. If approved, more than 60 new policies would be available to consumers. The graphic above lists each company and the Metal plans they will be offering. New carriers include: Columbia United Providers, Health Alliance Northwest, and UnitedHealthcare (UHC).

Enrollment in student medical plans at colleges in the Seattle area is dwindling. Although there are several explanations, the availability of subsidized Marketplace plans and options to stay on a parent’s plan are the main reasons. International students, who often are not eligible for Exchange coverage, are sometimes highly dependent on University benefits.

Seattle Pacific and Washington State Universities have already terminated their undergraduate medical policies and more schools are expected to follow.

Washington Health Marketplace prices are rising. Although not all plans are substantially increasing, we have listed below carrier rate change requests that have not yet been approved by the Department of Insurance.

49.61% – Time Individual Medical Plan

19.63% – Moda On-Exchange Gold/Silver

17.98% – Moda Off-Exchange Gold/Silver

14.34% – Premera Blue Cross Multi-State In-Exchange Gold

14.21% – Aetna Fee For Service Full Group

13.21% – Aetna PPO Bronze Saver Small Group

11.50% – Health Net of Oregon PPO Small Group

10.39% – Premera Blue Cross Multi-State In-Exchange Silver

More than 1.5 million persons have enrolled in coverage so far this year through the Washington Health Benefit Exchange. The vast majority of persons have obtained coverage through Medicaid (Apple Health). The average tax subsidy has averaged more than $200, saving state residents millions of dollars in premiums. Also, the total number of uninsured persons in the state has dropped about 10% over the last three years.