Texas Health Insurance Open Enrollment (OE) provides affordable TX Marketplace medical coverage to individuals, families and small businesses. The Affordable Care Act (Obamacare) offers up to a 100% federal subsidy to help Texans purchase healthcare at a heavily discounted (and sometimes) free cost. We make it easy for you to compare all available plans and rates. Regardless if you live in Dallas, Houston, Austin, San Antonio, or any other city in the state, low-cost options are offered. After this period, additional policies are available.

Seniors can also review attractive 2024 Medigap options for Medicare Supplement and Advantage plans. Part D prescription drug coverage can also be purchased separately, or packaged with many Advantage contracts. Supplement plans are standardized, but there will be differences in cost and network coverage area. Persons that have reached age 65, and have enrolled in Medicare Parts A and B, may be eligible for several options. Prescription drug plans can be purchased separately, and are also included in many Advantage contracts.

TX Open Enrollment

Open Enrollment typically begins on November 1st and ends on January 15th. However, “special enrollment periods” allow you to qualify for coverage throughout the year. This is the ninth year that Marketplace plans are available, and federal subsidies continue to be offered. You can choose high-deductible ($9,450) Bronze-tier plans that are very inexpensive, or more comprehensive Silver, Gold, or Platinum-tier plans, that offer lower deductibles and fewer out-of-pocket expenses.

In previous years, as many as 16 companies offered Exchange contracts in the state. Only Michigan and Ohio offered as many choices to their residents. However, Humana, Prominence, Bright, and Friday recently stopped offering Exchange coverage. Current carriers offering 2024 plans include Ascension, Cigna, Aetna, Ambetter, BCBS Of Texas, CHRISTUS, Moda, Sendero, Scott And White, SHA/FirstCare, UnitedHealthcare, Community Health Choice, Molina, Imperial, and Oscar. The number of available policies remains at more than 100, with most applicants qualifying for the federal subsidy. The average monthly premium should continue to remain under $120.

Molina is offering policies in several additional areas, including portions of Houston and Fort Worth. Their service areas include Denton, Bexar, Montgomery, Tarrant, and Fort Bend counties. The four new carriers last year were UnitedHealthcare, Moda, Bright Health, and Aetna CVS Health. Additional companies may join in 2025.

More than two million person signed up last year for coverage, a substantial increase from the previous year. The longer enrollment period was a major factor, although previously, an extension period was provided for applicants that were impacted by recent hurricanes. More than 1.3 million persons enrolled in the prior year. Note: Medicaid expansion has not been approved in Texas, although it is annually discussed.

Harris County had the largest number of persons signing up for coverage. Previously, about 20% of the state’s total enrollment was from Harris County. Several additional counties with high enrollment included Fort Bend, Austin, Walker, Montgomery, Chambers and Matagorda.

Noncompliance Penalty Has Been Removed

The tax penalty for not securing coverage that meets the Obamacare requirements was 2.5% of household income. This individual mandate penalty was pro-rated, so if you were without coverage only part of the year, a smaller penalty was imposed. The maximum tax was $2,085 ($695 per adult, and $347.50 per child). For example, if you suffered through financial hardship, or had significant unpaid medical bills, a waiver was granted. This penalty terminated two years ago.

How To View Texas Health Insurance Rates

The easiest way is through the quote box at the top of the page. Once your zip code is provided, and after answering a few basic questions, moments later, you will be able to view prices from the participating companies. Individual and family policies are offered through Open Enrollment. Each year, a new period begins, typically around mid-November. Occasionally (such as 2014) there are extensions to give more time to persons who procrastinated too long, simply forgot, or were having enrollment issues.

Harris County Features Some Of The Lowest Health Insurance Rates In Texas

The application process is much more streamlined with the average purchase now only taking about 10-25 minutes. There are less invasive questions, despite the increased policy availability. Ancillary benefits are also offered, including dental and vision. Separately, you can add policies that specialize in critical illness and/or accidental expenses.

How Much Does TX Medical Coverage Cost? Is It Free?

Actually, it could be free if you qualify for 100% of the subsidy. Otherwise, you may be eligible for a rate reduction based on your household income. For example, in the Dallas area, a family of three (40 year-old parents and one child) that make $60,000 per year will receive a $1,385 per month federal subsidy to help pay the premium. A $75,000 household income generates a subsidy of $1,191 per month.

A family of four with a $80,000 household income earns a $1,607 monthly subsidy. Higher household incomes may force the elimination of subsidy-eligibility. Lower household incomes may allow adults or children to become eligible for Medicaid or CHIP. Increases in household income could impact eligibility.

2024 Average Rate Changes:

Aetna – 14.94% increase

Ambetter – 7.68% increase

BCBS Of Texas – 0.24% decrease

CHRISTUS: – 1.42% decrease

Cigna – 12.40% increase

Community First Insurance Plans – 9.47% increase

Community Health Choice – 6.90% increase

Imperial – 2.97% increase

Moda – 9.39% increase

Molina – 8.23% increase

Oscar – 3.39% increase

Scott And White Health Plan – 1.20% increase

Sendero Health Plans – 10.54% decrease

Superior Health Plan – 4.93% increase

UnitedHealthcare – 4.99% increase

US Health & Life – 13.40% increase

Listed below are many of the most popular and affordable medical plans, and a basic outline of their coverage. Since several carriers are regional, not all plans are offered in each county. Network providers also vary, depending on the specific company, and county of residence.

TX Private Health Insurance Plans

Catastrophic Plans

BCBS Of Texas Blue Advantage Security HMO 200 – $9,450 deductible with maximum out-of-pocket expenses of $9,450 and 0% coinsurance. First three pcp office visits (including mental health) are subject to a $20 copay.

Bronze Plans

Oscar Bronze Classic Standard – $7,500 deductible with maximum out-of-pocket expenses of $9,400 and 50% coinsurance. $50 and $100 office visit copays. $75 copay for Urgent Care visits. Generic drug copay is $25 ($75 mail order).

Oscar Bronze Classic – $7,750 deductible with maximum out-of-pocket expenses of $9,100 and 50% coinsurance. $80 office visit copays. $100 copay for Urgent Care visits. Preferred generic drug copay is $3 ($9 mail order). Non-preferred generic drug copay is $30 ($90 mail order). $10 and $50 copays for lab work and x-rays (subject to deductible).

Oscar Bronze Classic 4700 – $4,700 deductible with maximum out-of-pocket expenses of $9,100 and 50% coinsurance. $70 and $125 office visit copays. $125 copay for Urgent Care visits. Preferred generic drug copay is $3 ($9 mail order). Non-preferred generic drug copay is $30 ($90 mail order). $25 and $70 copays for lab work and x-rays (subject to deductible).

Oscar Bronze Simple Standard – $9,100 deductible with maximum out-of-pocket expenses of $9,100 and 0% coinsurance. $75 copay for Urgent Care visits. Preferred generic drug copay is $3 ($7.50 mail order). Non-preferred generic drug copay is $30 ($75 mail order).

Oscar Bronze Classic – $7,750 deductible with maximum out-of-pocket expenses of $9,100 and 50% coinsurance. $50 copay for first pcp office visit. $75 copay for Urgent Care visits. Preferred generic drug copay is $3 ($9 mail order). Non-preferred generic drug copay is $30 ($90 mail order). $10 and $50 copays for lab work and x-rays (subject to deductible).

Oscar Simple HSA – $5,200 deductible with maximum out-of-pocket expenses of $7,450 and 50% coinsurance. HSA-eligible. Office visits and prescriptions subject to the deductible.

Oscar Bronze Simple Choice – $9,100 deductible with maximum out-of-pocket expenses of $9,100 and 0% coinsurance. $75 copay for Urgent Care visits. Preferred generic drug copay is $3 ($9 mail order). Non-preferred generic drug copay is $30 ($90 mail order).

BCBS MyBlue Health Bronze 402 – $7,400 deductible with $9,100 maximum out-of-pocket expenses and 50% coinsurance. $100 pcp office visit copay (Select pcp $0 copay) with $60 copay for Urgent Care visits. Preferred generic and non-preferred generic drug copays are $5 and $15 ($15 and $45 for mail order).

BCBS Blue Advantage Bronze HMO 704 – $9,100, deductible with $9,100 maximum out-of-pocket expenses and 0% coinsurance.

BCBS Blue Advantage Bronze HMO 301 – $9,100, deductible with $9,100 maximum out-of-pocket expenses and 0% coinsurance.

BCBS Blue Advantage Bronze HMO 204 – $6,000 deductible with $9,100 maximum out-of-pocket expenses and 50% coinsurance. $45 pcp office visit copay with $60 copay for Urgent Care visits. Preferred generic and non-preferred generic drug copays are $5 and $15 ($15 and $45 for mail order).

FirstCare Vital Bronze HMO 009 – $7,600 deductible and maximum out-of-pocket expenses of $9,100 and 30% coinsurance. Office visit copays are $35 and $100 with a $100 Urgent Care copay. Tiers 1, 2, and 3 drug copays are $25, $55, and $150.

FirstCare Savers Bronze HMO HSA – $7,500 deductible and maximum out-of-pocket expenses of $7,500 and 0% coinsurance. HSA-eligible.

Community Health Choice Community Select Bronze 016 – $8,100 deductible and maximum out-of-pocket expenses of $9,100 and 50% coinsurance. $35 pcp office visit copay and $90 Urgent Care copay. $30 generic drug copay ($75 mail order).

Community Health Choice Community Value Bronze 11 – $9,100 deductible and maximum out-of-pocket expenses of $9,100 and 0% coinsurance.

Community Health Choice Community Premier Bronze 17 – $9,100 deductible and maximum out-of-pocket expenses of $9,100 and 0% coinsurance.

CHRISTUS Health Plan Standard Bronze – $9,100 deductible with maximum out-of-pocket expenses of $9,100 and 0% coinsurance.

CHRISTUS Health Plan Bronze – Two Free PCP Visits – $60 and $80 office visit copays (First two pcp visits are free) with $80 Urgent Care copay. $7,450 deductible with maximum out-of-pocket expenses of $9,100 and 50% coinsurance. Preferred generic and non-preferred generic drug copays are $0 and $30. $400 imaging copay.

IdealCare SelectCare Bronze High Deductible – HSA-eligible plan with $8,550 deductible with maximum out-of-pocket expenses of $8,550 and 0% coinsurance.

IdealCare SelectCare Bronze On Exchange Standard – $9,100 deductible with maximum out-of-pocket expenses of $9,100 and 0% coinsurance.

IdealCare SelectCare / $25 PCP/ $11 Gen Rx – $25 pcp office visit copay with $11 generic drug copay. $8,550 deductible with maximum out-of-pocket expenses of $8,600.

Aetna CVS Bronze S – $7,500 deductible with maximum out-of-pocket expenses of $9,000 and 50% coinsurance. Office visit copays are $50 and $100 with a $75 Urgent Care copay. Generic and preferred generic drug copays are $25 and $62.50 (mail order).

Moda Select Texas Standard Bronze – $9,100 deductible and maximum out-of-pocket expenses of $9,100 and 0% coinsurance. Office visit copays are $85 and $120 with a $120 Urgent Care copay. Value Tier and Select Tier drug copays are $2 and $25 ($6 and $75 mail order).

Moda Select Bronze 8700 – $8,700 deductible and maximum out-of-pocket expenses of $8,700 and 0% coinsurance. Office visit copays are $85 and $120 with a $120 Urgent Care copay. Value Tier and Select Tier drug copays are $2 and $25 ($6 and $75 mail order).

Moda Select Bronze HSA 6900 – $6,900 deductible and maximum out-of-pocket expenses of $6,900 and 0% coinsurance. HSA-eligible.

Scott And White Virtual Bronze HMO 009 – $7,600 deductible with maximum out-of-pocket expenses of $9,100 and 30% coinsurance. $35 and $100 office visit copays ($0 copay for first sick visit). $100 copay for Urgent Care visits. $25 generic drug copay. Preferred brand and non-preferred brand drug copays are $55 and $150 (subject to policy deductible).

Scott And White Virtual Bronze HMO 007 – $7,500 deductible with maximum out-of-pocket expenses of $9,000 and 50% coinsurance. $50 and $100 office visit copays. $75 copay for Urgent Care visits. $25 generic drug copay. Preferred brand and non-preferred brand drug copays are $50 and $100 (subject to policy deductible).

UnitedHealthcare Bronze Standard $9,100 Deductible – $9,100 deductible with maximum out-of-pocket expenses of $9,100 and 0% coinsurance.

UnitedHealthcare Bronze Essential – $9,100 deductible with maximum out-of-pocket expenses of $9,100 and 0% coinsurance. $3 Tier 1 drug copay.

Ascension Personalized Care Standard Expanded Bronze – $7,500 deductible with maximum out-of-pocket expenses of $9,000 and 50% coinsurance. $50 and $100 office visit copays. $75 copay for Urgent Care visits. $25 generic drug copay. Preferred brand and non-preferred brand drug copays are $50 and $100 (subject to policy deductible).

Ascension Personalized Care Balanced Bronze 1 – $8,000 deductible with maximum out-of-pocket expenses of $9,100 and 50% coinsurance. $50 and $100 office visit copays. $20 generic drug copay. Preferred brand and non-preferred brand drugs are subject to policy deductible.

Silver Plans

BCBS myBlue Health Silver 405 – $3,550 deductible with $8,700 maximum out-of-pocket expenses and 40% coinsurance. $0 and $30 pcp office visit copays with $50 copay for Urgent Care visits. Preferred generic and non-preferred generic drugs receive $5 and $15 copays ($15 and $45 copays for mail-order).

BCBS Blue Advantage Silver HMO 205 – $2,050 deductible with $8,700 maximum out-of-pocket expenses and 50% coinsurance. $15 pcp office visit copay with $15 copay for Urgent Care visits. Preferred generic and non-preferred generic drugs receive $5 and $15 copays ($15 and $45 copays for mail-order).

BCBS Blue Advantage Plus Silver HMO 202 – $1,250 deductible with $8,700 maximum out-of-pocket expenses and 50% coinsurance. $15 pcp office visit copay with $15 copay for Urgent Care visits. Preferred generic and non-preferred generic drugs receive $5 and $15 copays ($15 and $45 copays for mail-order).

Ambetter Balanced Care 30 – $6,100 deductible with maximum out-of-pocket expenses of $6,100 and 0% coinsurance.

Ambetter Balanced Care 31 – $5,450 deductible with maximum out-of-pocket expenses of $6,450 and 10% coinsurance.

Ambetter Balanced Care 32 – $45 and $100 office visit copays with $60 Urgent Care copay. $8,100 deductible with maximum out-of-pocket expenses of $8,700 and 50% coinsurance. Generic and preferred brand drugs receive $5 and $25 copays ($12.50 and $62.50 copays for mail-order). $50 copay for diagnostic tests.

Ambetter Value Silver 11 – $30 and $60 office visit copays with $60 Urgent Care copay. $6,000 deductible with maximum out-of-pocket expenses of $8,500 and 40% coinsurance. Preferred generic and generic drugs receive $5 and $20 copays ($12.50 and $30 copays for mail-order). The preferred brand drug copay is $55 ($82.50 mail order). $30 copay for diagnostic tests.

Oscar Silver Simple – PCP Saver Plan – $20 pcp office visit copays with $75 Urgent Care copay. $5,000 deductible with maximum out-of-pocket expenses of $8,375 and 40% coinsurance. Preferred generic and generic drug copays are $3 and $20 ($9 and $60 mail order). $10 copay for lab work.

Oscar Silver Simple – Specialist Saver Plan – $40 office visit copays with $75 Urgent Care copay. $6,450 deductible with maximum out-of-pocket expenses of $8,700 and 50% coinsurance. Preferred generic and generic drug copays are $3 and $25 ($9 and $75 mail order). Preferred brand drug copay is $75. $10 copay for lab work.

Oscar Silver Simple Plan – $25 and $90 office visit copays with $75 Urgent Care copay. $4,200 deductible with maximum out-of-pocket expenses of $8,700 and 50% coinsurance. Preferred generic and generic drug copays are $3 and $20 ($9 and $60 mail order). Preferred brand drug copay is $60. $10 copay for lab work.

Oscar Silver Classic Plan – $35 and $95 office visit copays with $50 Urgent Care copay. $5,750 deductible with maximum out-of-pocket expenses of $8,700 and 50% coinsurance. Preferred generic and generic drug copays are $3 and $25 ($9 and $75 mail order). Preferred brand drug copay is $100. $10 copay for lab work.

IdealCare Silver – $4,250 deductible with maximum out-of-pocket expenses of $7,500 and 25% coinsurance. $20 (deductible does not apply) and $60 office visit copays. $60 Urgent Care copay. The generic, preferred brand and non-preferred brand drug copays are $10, $40, and $80.

Community Health Choice Standard Silver 12 – $30 and $60 office visit copays with $60 Urgent Care copay. $6,000 deductible with $8,700 maximum out-of-pocket expenses and 50% coinsurance. Generic and preferred brand drugs receive $10 and $80 copays ($25 and $200 copays for mail-order). Non-preferred brand drug copays are $120 and $300 (after the deductible). Diagnostic tests have a $30 copay after the deductible.

Community Health Choice Community Silver 15 – $0 and $40 office visit copays. $4,000 deductible with $8,700 maximum out-of-pocket expenses and 50% coinsurance. Generic and preferred brand drugs receive $10 and $80 copays ($25 and $200 copays for mail-order).

Molina Constant Care Silver 7 250 – $30 and $90 office visit copays with $30 Urgent Care copay. $0 deductible with $8,550 maximum out-of-pocket expenses. Generic and preferred brand drugs receive $30 and $100 copays ($60 and $200 mail order). 40% coinsurance applies to other drugs. $50 copay for blood tests. $135 copay for x-rays.

Molina Constant Care Silver 4 – $30 and $65 office visit copays with $30 Urgent Care copay. $7,450 deductible with $7,450 maximum out-of-pocket expenses and 0% coinsurance. Generic and preferred brand drugs receive $25 and $75 copays.

CHRISTUS Texas Individual Silver High-Deductible Standard – $10 and $35 office visit copays with $35 Urgent Care copay. First two pcp office visits are covered at 100%. $8,600 deductible with maximum out-of-pocket expenses of $8,700 and 50% coinsurance. Preferred generic and non-preferred generic drugs receive $0 and $5 copays. $30 copay for x-rays.

CHRISTUS Texas Individual Basic Silver – $3,000 deductible with maximum out-of-pocket expenses of $8,700 and 50% coinsurance.

FirstCare Prime Silver HMO 008 – $35 and $70 office visit copays with $70 Urgent Care copay. $8,550 deductible with maximum out-of-pocket expenses of $8,550 and 0% coinsurance. Tier 1 drug copay is $15.

Scott And White Virtual Prime Silver HMO 008 – $8,550 deductible with maximum out-of-pocket expenses of $8,550 and 0% coinsurance. $35 and $70 office visit copays. $70 copay for Urgent Care visits. $15 generic drug copay.

Note: The Community Health Choice HMO Silver 009 plan was previously one of the most popular Silver-tier options. However, it currently not available.

Gold Plans

Molina Confident Care Gold 1 – $10 and $50 office visit copays with $10 Urgent Care copay. $2,925 deductible with $6,500 maximum out-of-pocket expenses and 20% coinsurance. Generic and preferred brand drugs receive $10 and $50 copays. 30% coinsurance applies to other drugs. $15 copay for blood work.

Molina Confident Care Gold 3 – $30 and $70 office visit copays with $60 Urgent Care copay. No deductible with $8,150 maximum out-of-pocket expenses and 20% coinsurance. Generic and preferred brand drugs receive $25 and $70 copays. 30% coinsurance applies to other drugs. $30 copay for blood work.

Ambetter Secure Care 5 – $15 and $35 office visit copays. $35 Urgent Care copay. $1,250 deductible with maximum out-of-pocket expenses of $5,900 and 20% coinsurance. Generic and preferred brand drug copays are $15 and $30 ($37.50 and $75 mail order).

FirstCare IND Gold HMO 2000 – $20 and $60 office visit copays with $60 Urgent Care copay. $2,000 deductible with $8,150 maximum out-of-pocket expenses and 20% coinsurance. Tier 1, 2, 3, and 4 drug copays are $15, $55, $150, and $500.

FirstCare IND Gold HMO 0 – $30 and $50 office visit copays with $50 Urgent Care copay. $0 deductible with $8,150 maximum out-of-pocket expenses and 20% coinsurance. Tier 1, 2, 3, and 4 drug copays are $15, $55, $150, and $500.

BCBS Of Texas Blue Advantage Gold HMO 206 – $30 pcp office visit copay for the first three office visits. Specialist office visits are subject to coinsurance and deductible. Urgent Care copay is $45. $750 deductible with maximum out-of-pocket expenses of $8,150 and 40% coinsurance. Preferred generic and non- preferred generic drugs receive $0-$10 and $10-$20 copays. Preferred brand and non-preferred brand drugs are subject to coinsurance.

BCBS Of Texas Blue Advantage Plus Gold 203 – $15 and $50 office visit copays with $50 Urgent Care copay. $750 deductible with maximum out-of-pocket expenses of $8,150 and 30% coinsurance. Preferred generic and non- preferred generic drugs receive $0-$10 and $10-$20 copays. Preferred brand and non-preferred brand drugs are subject to coinsurance.

Community Health Choice HMO Gold 005 – $20 and $40 office visit copays with $40 Urgent Care copay. $750 deductible with $6,500 maximum out-of-pocket expenses. Generic drug copays are $10 and $25. Preferred brand and non-preferred brand drugs subject to coinsurance.

Community Health Choice HMO Gold 001 – $30 and $65 office visit copays with $65 Urgent Care copay. $0 deductible with $8,150 maximum out-of-pocket expenses. Generic and preferred brand drugs receive $20 and $40 copays ($50 and $100 copays for mail-order). Non-preferred brand drug copays are $80 and $200.

IdealCare Total Standard Gold – $350 deductible with maximum out-of-pocket expenses of $5,500 and 20% coinsurance. Diagnostic tests are subject to a $20 copay, and the imaging coinsurance is 50%. The generic, preferred brand, and non-preferred brand drug copays are $0, $40, and $80.

Oscar Classic Gold – $25 and $50 office visit copays with $75 Urgent Care copay. $1,700 deductible with maximum out-of-pocket expenses of $8,150 and 20% coinsurance. Generic and preferred brand drugs receive $3 and $50 copays ($7.50 and $125 copays for mail-order).

CHRISTUS Texas Individual Gold – $10 and $35 office visit copays with $35 Urgent Care copay. First two pcp office visits are free. $2,400 deductible with maximum out-of-pocket expenses of $7,900 and 15% coinsurance. Preferred generic, non-preferred generic, preferred brand, and non-preferred brand drug copays are $0, $4, $35, and $75.

Household Income Guidelines

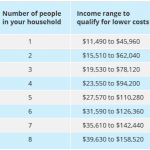

Shown below are the specific income range guidelines (courtesy of .gov) that show specific eligibility maximums for individuals and families. For example, a single person could make up to $45,000 and still receive some financial aid. A family of three could have household income up to $78,000 and receive a partial federal subsidy. A family of eight could earn as much as $150,000 and possibly receive a subsidy. These limits are non-negotiable (at this time) and apply to all states, not just Texas.

Get Lower Texas Health Exchange Prices

TX-SB1264

TX-SB1264 is the legislation that protects consumers against surprise balance billing. When a patient unknowingly uses an out-of-network provider, a higher cost can no longer be charged. This situation often occurs when the closest hospital is is not “in-network,” or out-of-network providers treat you in a facility that is in your carrier’s network. Often, it is a specialist, including an anesthesiologist, radiologist, or an associate surgeon. The legislation applies to all state-regulated plans.

Unlike New York’s similar legislation, Texas does not define “reasonable and customary.” Also, New York’s arbitration is handled by professional and licensed billing coders and doctors. In Texas, the process is administered by professionals experienced in insurance and contract legislation. Typically, 10 factors are considered from a benchmarking database. The 50th percentile of medical plan payments for similar area services and 80th percentile of provider billing charges must be examined.

The arbitration process is allotted 51 days, which includes a 30-day informal teleconference. Currently, the practice of balance billing is prohibited with the total bill being reviewed during the arbitration process. The party that is closest to the “reasonable” cost of treatment wins.

What About The High Risk Pool?

The Texas High Risk Pool, which has provided affordable medical coverage for state residents that could not qualify for individual coverage, shut down six years ago. For 15 years, government grants and insurer funding financed the program. But past members (about 25,000) were able to apply for guaranteed coverage through the State Marketplace. Of course, medical plans for young adults are available, and typically cost less than adult plans. However, it is possible that President Trump will propose a return of the High Risk Pools, each managed by their home state. By the beginning of 2021, specific guidelines, if approved by Congress, will be published.

Enrollment Deadlines

The deadline for obtaining a Jan 1 effective date, and thus, avoiding a lapse, is typically December 15th. Each member is notified in many ways (phone calls and letters) to help expedite the transition of benefits. For many consumers, the savings from changing plans is substantial…easily thousands of dollars per year. Occasionally, a carrier will cease offering private coverage, and termination letters are sent. Typically, correspondence is sent about three months before the current policy expires, which provides ample time to shop for a new plan. Often, the new plan will feature a larger network of doctors, specialists, and hospitals.

Another advantage of Marketplace coverage is the benefits that are received. Since 10 “Essential Health Benefits” must be included in all newly-issued plans, perhaps one of the biggest challenges is understanding all of the changes each year, and evaluating which Metal policy is the best choice. Also, it is possible to buy a policy that is not listed on the “Exchange.” One of the advantages of these types of policies is that the number of participating physicians and specialists may be higher than other options.

Texas Senior Health Insurance (Medicare Supplement, Advantage (MA), And Part D Prescription Drug)

Medicare Supplement coverage is offered by many TX carriers. All companies must offer Plan A. However, if they also market additional options, Plan C or F must also be made available. Additional contracts, including a high-deductible Plan F, can also be considered. A summary of your rights (Consumer Bill Of Rights) must be provided when you purchase any policy. Plans are standardized, which makes the comparison process much easier than comparing under-65 contracts. The Texas DOI must approve all companies that conduct business in the state.Listed below are the companies approved to sell Medicare Supplement plans in Texas:

Aetna, American National Life American Republic, American Retirement Life, Americo, Assured Life, Bankers Fidelity, BCBS Of Texas, Central States, Christian Fidelity, Colonial Penn, Combined Insurance, Continental Life, Coventry, CSI Life, Equitable, First Health, Gerber, Globe, Government Personnel, Guarantee Trust, Heartland National, Humana, Individual Assurance, Liberty National, Loyal American, Manhattan Life, Marquette National, Medico, Old Surety Life, Omaha Insurance, Oxford Life, Physicians Mutual, Reserve National, Sentinel Security, Standard Life And Accident, Standard Life And Casualty, State Farm, Thrivent, Transamerica, Unified Life, United American, United Commercial, Travelers, United National Life, UnitedHealthcare, Universal Fidelity Life, and USAA.

Medicare Supplement

Shown below are estimated current monthly rates for selected plans in the state’s largest counties for a 65 year-old male. Female rates are usually lower. Companies typically do not offer all available plans in each county.

Harris County Plan A

$110 – Amerigroup

$112 – Elips Life

$114 – Philadelphia American Life

$115 – Manhattan Life

$115 – Medico

$116 – United States Fire

$118 – Central States

$118 – Capitol Life

$118 – Accendo

$121 – Union Security

$122 – Aetna

$123 – Omaha Supplemental

$128 – Humana

$126 – Amerigroup

$128 – Lumico

$128 – Western United Life

$129 – United American

$134 – National Health

$140 – Great Southern Life

$143 – Bankers Fidelity

$152 – GPM Health

$154 – Cigna

$168 – Heartland National

$179 – Oxford Life

$206 – BCBS of Texas

$210 – Sentinel Security

$156 – Medico

$177 – Oxford Life

$183 – AARP-UnitedHealthcare

$183 – Americo

$192 – Humana

$197 – Gerber

Harris County Plan C

$168 – Western United Life

$168 – AARP-UnitedHealthcare

$257 – Sentinel Security

$280 – Assured Life

Harris County Plan F

$125 – SBLI USA Life

$141 – Elips Life

$145 – Manhattan Life

$146 – United States Fire

$148 – Central States

$150 – Cigna

$150 – AARP-UnitedHealthcare

$150 – AFLAC

$153 – Accendo

$161 – Mutual Of Omaha

$162 – Bankers Fidelity

$165 – Medico

$169 – Capitol Life

$169 – Amerigroup

$171 – Aetna

$176 – BCBS Of Texas

$184 – Humana

$185 – National Health

$187 – Union Security

$198 – Great Southern Life

$221 – GPM Health

$236 – Guarantee Trust Life

$242 – United American

$243 – Oxford Life

$267 – Heartland National

Harris County Plan F (HD)

$43 – Philadelphia American

$45 – United American

$48 – Aetna

$49 – Medico

$51 – Great Southern Life

$52 – BCBS

$58 – National Health

Harris County Plan G (HD)

$36 – Philadelphia American

$43 – Mutual Of Omaha

$43 – Cigna

$44 – United States Fire

$45 – United American

$46 – Elips Life

$47 – Medico

$49 – Bankers Fidelity

$51 – Humana

$52 – BCBS

$58 – National Health

Harris County Plan N

$83 – SBLI USA Life

$84 – Cigna

$84 – AARP-UnitedHealthcare

$91 – Elips Life

$92 – Mutual Of Omaha

$93 – Capitol Life

$94 – United States Fire

$94 – AFLAC

$94 – Manhattan Life

$94 – Aetna

$95 – Central States

$96 – Philadelphia American

$98 – Cigna

$102 – Union Security

$102 – Bankers Fidelity

$103 – BCBS

$104 – National Health

$106 – Medico

$108 – Amerigroup

$116 – GPM Health

$118 – Humana

$124 – Great Southern Life

$137 – Guarantee Trust Life

$172 – Heartland National

$173 – Oxford Life

$208 – United American

$216 – Sentinel Security

Dallas County Plan C

$152 – Western United Life

$172 – AARP-UnitedHealthcare

$257 – Sentinel Security

$280 – Assured Life

Dallas County Plan F (HD)

$33 – United American

$37 – Philadelphia American

$43 – Thrivent

$44 – Cigna

$63 – Humana

$69 – Aetna

Dallas County Plan N

$96 – Shenandoah Life

$99 – Transamerica

$99 – Guarantee Trust Life

$100 – Cigna

$101 – Greek Catholic Union

$101 – Western United Life

$013 – Equitable National Life

$107 – CSI Life

$108 – Liberty Bankers Life

$110 – Aetna

$110 – Pekin Life

$120 – AARP-UnitedHealthcare

$122 – Humana

$124 – Individual Assurance

$129 – American Retirement Life

$131 – Oxford Life

$138 – Christian Fidelity Life

$139 – Combined Insurance

$139 – Medico

$160 – United American

Tarrant County Plan F

$147 – Philadelphia American

$151 – Cigna

$151 – Guarantee Trust Life

$154 – Western United Life

$156 – Equitable National Life

$158 – Shenandoah Life

$162 – Liberty Bankers Life

$164 – AARP-UnitedHealthcare

$166 – Greek Catholic Union

$171 – Pekin Life

$172 – Aetna

$174 – Transamerica Premier

$177 – United American

$178 – Combined Insurance

$180 – Humana

$185 – Thrivent

$185 – Companion Life

$188 – CSI Life

$190 – Medico

$191 – Oxford Life

$202 – Individual Assurance

$206 – American Retirement Life

$268 – Gerber

Tarrant County Plan F (HD)

$33 – United American

$41 – Philadelphia American Life

$43 – Cigna

$50 – United World Life

$57 – Humana

$66 – Aetna

Tarrant County Plan G

$114 – Philadelphia American

$117 – Cigna

$118 – Manhattan Life

$120 – Transamerica

$121 – Greek Catholic Union

$128 – CSI Life

$129 – United World Life

$129 – Oxford Life

$130 – Aetna

$134 – AARP-UnitedHealthcare

$134 – Pekin Life

$151 – Central States

$157 – American Retirement Life

$159 – Equitable

$188 – Gerber

$206 – United American

Bexar County Plan Plan F

$138 – Transamerica

$144 – Cigna

$146 – AARP-UnitedHealthcare

$147 – Philadelphia American

$155 – Greek Catholic Union

$158 – Shenandoah Life

$159 – Pekin Life

$160 – Manhattan Life

$164 – Aetna

$168 – United American

$171 – CSI Life

$177 – Medico

$178 – United World Life

$179 – Oxford Life

$180 – Humana

$181 – Combined Insurance

$186 – Individual Assurance

$188 – American Retirement Life

$192 – Companion Life

$263 – Equitable

$273 – Gerber

Bexar County Plan F (HD)

$31 – United American

$41 – Philadelphia American

$43 – Cigna

$50 – United World LIfe

$57 – Humana

$66 – Aetna

Bexar County Plan N

$83 – Transamerica

$94 – Manhattan Life

$96 – Shenandoah Life

$100 – Cigna

$101 – Greek Catholic Union

$104 – AARP-UnitedHealthcare

$105 – United World Life

$107 – CSI Life

$110 – Aetna

$110 – Pekin Life

$111 – Humana

$117 – Individual Assurance

$119 – Oxford Life

$121 – American Retirement Life

$123 – Medico

$146 – Combined Insurance

$151 – United American

$176 – Equitable

Medicare Advantage (Part C or MA)

TX Counties With The Most Available MA Plans

117 – Harris County

103 – Collin County

102 – Tarrant County

101 – Dallas County

100 – Bexar County

97 – Denton County

92 – Fort Bend County

88 – Montgomery County

80 – Galveston County

78 – El Paso County

77 – Jefferson County

76 – Rockwall County

75 – Comal County

73 – Liberty County

72 – Johnson County

72 – Williamson County

70 – Hardin County

70 – Orange County

69 – Parker County

69 – Wise County

Shown below are many available Advantage contracts that are issued by private carriers approved by Medicare. Parts A and B are provided by the insurer, instead of original Medicare. Additional benefits are often provided, including dental, vision, and hearing. All plans shown below include prescription drug benefits, unless otherwise specified. Prices, copays, deductibles, plan availability, and some benefits will vary throughout the state.

AARP Medicare Advantage from UHC TX-0015 – $0 deductible with maximum out-of-pocket expenses of $3,800. 3,634 formulary drugs are available. Inpatient hospital copay is $350. Outpatient hospital copay is $0-$250 per visit. Office visit copays are $0 and $0-$25, while the Urgent Care and ER copays are $0-$40 and $135. Diagnostic tests, procedures, and radiology services are subject to $20-$150 copays, outpatient x-rays have a $15 copay, and lab tests have a $0 copay. Outpatient mental health therapy visits are subject to $15 and $0-$25 copays (group and individual). Dental, hearing, and vision exams are covered, subject to policy limits. 30-day prescription drug cost-sharing copays are $0 (Tier 1), $0 (Tier 2), $47 (Tier 3), $100 (Tier 4), and 33% (Tier 5). Podiatry services copay is $25.

AARP Medicare Advantage Plan 1 – $0 deductible with maximum out-of-pocket expenses of $3,900. 3,682 formulary drugs are available. Inpatient hospital copay is $350. Outpatient hospital copay is $0-$250. Office visit copays are $0 and $25, while the Urgent Care and ER copays are $40 and $90. Diagnostic tests, procedures, and radiology services are subject to $0-$150 copays, outpatient x-rays have a $15 copay, and lab tests have a $0 copay. Outpatient mental health therapy visits are subject to $15 and $25 copays (group and individual). Dental, hearing, and vision exams are covered, subject to policy limits. 30-day prescription drug cost-sharing copays are $0 (Tier 1), $12 (Tier 2), $47 (Tier 3), $100 (Tier 4), and 33% (Tier 5). Podiatry services copay is $25.

AARP Medicare Advantage – $0 deductible with maximum out-of-pocket expenses of $3,900. 3,682 formulary drugs are available. Inpatient hospital copay is $295 for 5 days. Outpatient hospital copay is $0-$275. Office visit copays are $0 and $20, while the Urgent Care and ER copays are $40 and $90. Diagnostic tests, procedures, and radiology services are subject to $0-$120 copays, outpatient x-rays have a $0 copay, and lab tests have a $0 copay. Outpatient mental health therapy visits are subject to $15 and $25 copays (group and individual). Dental, hearing, and vision exams are covered, subject to policy limits. 30-day prescription drug cost-sharing copays are $0 (Tier 1), $10 (Tier 2), $47 (Tier 3), $100 (Tier 4), and 33% (Tier 5). Podiatry services copay is $20.

AARP Medicare Advantage SecureHorizons Plan 1 – $0 deductible with maximum out-of-pocket expenses of $3,900. 3,682 formulary drugs are available. Inpatient hospital copay is $250 for 5 days. Outpatient hospital copay is $0-$225. Office visit copays are $0 and $20, while the Urgent Care and ER copays are $40 and $90. Diagnostic tests, procedures, and radiology services are subject to $0-$95 copays, outpatient x-rays have a $0 copay, and lab tests also have a $0 copay. Outpatient mental health therapy visits are subject to $15 and $25 copays (group and individual). Dental, hearing, and vision exams are covered, subject to policy limits. 30-day prescription drug cost-sharing copays are $2 (Tier 1), $14 (Tier 2), $47 (Tier 3), $100 (Tier 4), and 33% (Tier 5). Podiatry services copay is $20.

AARP Medicare Advantage SecureHorizons Plan 2 – $0 deductible with maximum out-of-pocket expenses of $3,200. 3,708 formulary drugs are available. Inpatient hospital copay is $150. Outpatient hospital copay is $0-$150. Office visit copays are $0 and $20, while the Urgent Care and ER copays are $40 and $90. Diagnostic tests, procedures, and radiology services are subject to $0-$125 copays, outpatient x-rays have a $0 copay, and lab tests also have a $0 copay. Outpatient mental health therapy visits are subject to $15 and $25 copays (group and individual). Dental, hearing, and vision exams are covered, subject to policy limits. 30-day prescription drug cost-sharing copays are $0 (Tier 1), $10 (Tier 2), $47 (Tier 3), $100 (Tier 4), and 33% (Tier 5). Podiatry services copay is $20.

AARP Medicare Advantage Choice – $260 deductible with maximum out-of-pocket expenses of $6,700. 3,676 formulary drugs are available. Inpatient hospital copay is $325 for 6 days. Outpatient hospital copay is $0-$325. Office visit copays are $0 and $35, while the Urgent Care and ER copays are $40 and $90. Diagnostic tests, procedures, and radiology services are subject to $0-$150 copays, outpatient x-rays have a $15 copay, and lab tests also have a $0 copay. Outpatient mental health therapy visits are subject to $15 and $25 copays (group and individual). Dental, hearing, and vision exams are covered, subject to policy limits. 30-day prescription drug cost-sharing copays are $3 (Tier 1), $14 (Tier 2), $47 (Tier 3), $100 (Tier 4), and 28% (Tier 5).

Aetna Medicare Premier Plan – $250 deductible with maximum out-of-pocket expenses of $5,900. 3,663 formulary drugs are available. Inpatient hospital copay is $325 for the first 6 days. Outpatient hospital copay is $0-$250 per visit. Office visit copays are $0 and $40, while the Urgent Care and ER copays are $0-$65 and $90. Diagnostic tests and procedures have a $0- $50 copay, radiology services are subject to 0%-20% coinsurance, and outpatient x-rays and lab tests have a $40 and $0 copay. Outpatient mental health therapy visits are subject to $40 copays (group and individual). Dental, hearing, and vision exams are covered, subject to policy limits. 30-day prescription drug cost-sharing copays are $0 (Tier 1), $0 (Tier 2), $47 (Tier 3), $100 (Tier 4), and 28% (Tier 5).

Aetna Medicare Choice Plan – $300 deductible with maximum out-of-pocket expenses of $7,550. 3,663 formulary drugs are available. Inpatient hospital copay is $325 for the first 5 days. Outpatient hospital copay is $0-$275 per visit. Office visit copays are $0 and $35, while the Urgent Care and ER copays are $0-$65 and $90. Diagnostic tests and procedures have a $0- $40 copay, radiology services are subject to a $0- $325 copay, and outpatient x-rays and lab tests have $35 and $0 copays. Outpatient mental health therapy visits are subject to $40 copays (group and individual). The skilled nursing facility copay is $0 for days 1-20, and $184 for days 21-100. Dental, hearing, and vision exams are covered, subject to policy limits. 30-day prescription drug cost-sharing copays are $0 (Tier 1), $0 (Tier 2), $47 (Tier 3), $100 (Tier 4), and 27% (Tier 5).

Aetna Medicare Plus Plan – $350 deductible with maximum out-of-pocket expenses of $6,700. 3,773 formulary drugs are available. Inpatient hospital copay is $375 for the first 5 days. Outpatient hospital copay is $50-$325 per visit. Office visit copays are $0 and $50, while the Urgent Care and ER copays are $0-$65 and $90. Diagnostic tests and procedures have a $50 copay, radiology services are subject to a $375 copay, and outpatient x-rays and lab tests have $50 and $15 copays. Outpatient mental health therapy visits are subject to $40 copays (group and individual). The skilled nursing facility copay is $0 for days 1-20, and $178 for days 21-100. Dental, hearing, and vision exams are covered, subject to policy limits. 30-day prescription drug cost-sharing copays are $0 (Tier 1), $0 (Tier 2), $47 (Tier 3), $100 (Tier 4), and 26% (Tier 5).

Allwell Medicare – $0 deductible with maximum out-of-pocket expenses of $3,900. 4,012 formulary drugs are available. Inpatient hospital copay is $150 for the first 8 days. Outpatient hospital copay is $225 per visit. Office visit copays are $5 and $35, while the Urgent Care and ER copays are $65 and $90. Diagnostic tests and procedures have a $25 copay, radiology services are subject to 20% coinsurance, and outpatient x-rays and lab tests have a $0 copay. Outpatient mental health therapy visits are subject to $30-$35 copays (group and individual). The skilled nursing facility copay is $0 for days 1-20, and $178 for days 21-100. Dental, vision, and hearing exams are covered, subject to policy limits. 30-day prescription drug cost-sharing copays are $1 (Tier 1), $8 (Tier 2), $42 (Tier 3), $85 (Tier 4), and 33% (Tier 5).

Amerivantage Classic – $0 deductible with maximum out-of-pocket expenses of $2,500. 3,838 formulary drugs are available. Inpatient hospital copay is $225 for the first 5 days. Outpatient hospital copay is $0-$215 per visit. Office visit copays are $0 and $20, while the Urgent Care and ER copays are $35 and $120. Diagnostic tests and procedures have a $0-$50 copay, radiology services are subject to 20% coinsurance, and outpatient x-rays and lab tests have a $0 copay. Outpatient mental health therapy visits are subject to $40 copays (group and individual). The skilled nursing facility copay is $0 for days 1-20, and $140 for days 21-100. Dental, vision, and hearing exams are covered, subject to policy limits. 30-day prescription drug cost-sharing copays are $5 (Tier 1), $12 (Tier 2), $42 (Tier 3), $95 (Tier 4), and 33% (Tier 5).

Blue Cross Medicare Advantage Basic – $0 deductible with maximum out-of-pocket expenses of $3,400. 3,545 formulary drugs are available. Inpatient hospital copay is $350 per stay. Outpatient hospital copay is $175 per visit. Office visit copays are $0 and $30, while the Urgent Care and ER copays are $30 and $90. Diagnostic tests and procedures have a $0-$100 copay, radiology services are subject to a $250-$300 copay, and outpatient x-rays and lab tests have a $0-$100 copay. Outpatient mental health therapy visits are subject to $35 copays (group and individual). The skilled nursing facility copay is $0 for days 1-20, and $178 for days 21-100. Hearing, dental, and vision exams are covered, subject to policy limits. 30-day prescription drug cost-sharing copays are $0 (Tier 1), $8 (Tier 2), $39 (Tier 3), $95 (Tier 4), and 33% (Tier 5).

Blue Cross Medicare Advantage Choice Plus – $0 deductible with maximum out-of-pocket expenses of $6,700. 3,552 formulary drugs are available. Inpatient hospital copay is $372 for first five days. Outpatient hospital copay is $325 per visit. Office visit copays are $10 and $50, while the Urgent Care and ER copays are $40 and $90. Diagnostic tests and procedures have a $0-$100 copay, radiology services are subject to a $275-$325 copay, and outpatient x-rays and lab tests have a $5-$100 copay. Outpatient mental health therapy visits are subject to $30 copays (group and individual). The skilled nursing facility copay is $0 for days 1-20, and $178 for days 21-100. Hearing, dental, and vision exams are covered, subject to policy limits. 30-day prescription drug cost-sharing copays are $0 (Tier 1), $14 (Tier 2), $42 (Tier 3), $95 (Tier 4), and 25% (Tier 5).

Blue Cross Medicare Advantage Value – $0 deductible with maximum out-of-pocket expenses of $4,000. 3,552 formulary drugs are available. Inpatient hospital copay is $200 for first six days. Outpatient hospital copay is $225 per visit. Office visit copays are $0 and $40, while the Urgent Care and ER copays are $40 and $90. Diagnostic tests and procedures have a $0-$100 copay, radiology services are subject to a $225-$300 copay, and outpatient x-rays and lab tests have a $0-$100 copay. Outpatient mental health therapy visits are subject to $35 copays (group and individual). The skilled nursing facility copay is $0 for days 1-20, and $178 for days 21-100. Hearing and vision exams are covered, subject to policy limits. 30-day prescription drug cost-sharing copays are $0 (Tier 1), $8 (Tier 2), $39 (Tier 3), $95 (Tier 4), and 28% (Tier 5).

Care N’ Care Choice – $0 deductible with maximum out-of-pocket expenses of $3,900. 3,718 formulary drugs are available. Inpatient hospital copay is $250 for day 1, and $125 for days 2-6. Outpatient hospital copay is $250 per visit. Office visit copays are $15 and $35, while the Urgent Care and ER copays are $30 and $75. Diagnostic tests and procedures have a $10 copay, radiology services are subject to a $50-$200 copay, and outpatient x-rays and lab tests have a $10 copay. Outpatient mental health therapy visits are subject to $40 copays (group and individual). The skilled nursing facility copay is $0 for days 1-20, and $167.50 for days 21-100. Hearing and vision exams are covered, subject to policy limits. 30-day prescription drug cost-sharing copays are $5 (Tier 1), $15 (Tier 2), $47 (Tier 3), $100 (Tier 4), and 33% (Tier 5).

Care N’ Care Classic – $0 deductible with maximum out-of-pocket expenses of $2,900. 3,718 formulary drugs are available. Inpatient hospital copay is $225 for day 1, and $75 for days 2-5. Outpatient hospital copay is $175 per visit. Office visit copays are $0 and $15, while the Urgent Care and ER copays are $30 and $75. Diagnostic tests and procedures have a $0 copay, radiology services are subject to a $50-$200 copay, and outpatient x-rays and lab tests have a $10 copay. Outpatient mental health therapy visits are subject to $40 copays (group and individual). The skilled nursing facility copay is $0 for days 1-20, and $160 for days 21-100. Hearing, dental, and vision exams are covered, subject to policy limits. 30-day prescription drug cost-sharing copays are $0 (Tier 1), $10 (Tier 2), $40 (Tier 3), $95 (Tier 4), and 33% (Tier 5).

Humana Gold Plus – $200 deductible with maximum out-of-pocket expenses of $5,200. 3,430 formulary drugs are available. Inpatient hospital copay is $275 for days 1-5. Outpatient hospital copay is $20-$275 per visit. Office visit copays are $0 and $20, while the Urgent Care and ER copays are $0-$35 and $90. Diagnostic tests and procedures have a $0-$100 copay, radiology services are subject to a $0-$200 copay, and outpatient x-rays and lab tests have a $0-$95 copay. Outpatient mental health therapy visits are subject to $20 copays (group and individual). The skilled nursing facility copay is $0 for days 1-20, and $172 for days 21-100. Hearing and vision exams are covered, subject to policy limits. 30-day prescription drug cost-sharing copays are $2 (Tier 1), $5 (Tier 2), $47 (Tier 3), $99 (Tier 4), and 29% (Tier 5).

Imperial Health Insurance Traditional – $0 deductible with maximum out-of-pocket expenses of $4,000. 3,363 formulary drugs are available. Inpatient hospital copay is $100 for days 1-5. Outpatient hospital copay is $0. Office visit copays are $0 and $0, while the Urgent Care and ER copays are $0 and $90. Diagnostic tests and procedures have a $0 copay, radiology services are subject to a $0 copay, and outpatient x-rays and lab tests have a $0 copay. Outpatient mental health therapy visits are subject to $0 copays (group and individual). The skilled nursing facility copay is $0 for days 1-20, and $164.50 for days 21-100. Hearing and vision exams are covered, subject to policy limits. 30-day prescription drug cost-sharing copays are $0 (Tier 1), $5 (Tier 2), $45 (Tier 3), $90 (Tier 4), and 33% (Tier 5).

Lasso Healthcare (MSA) – $0 deductible with maximum out-of-pocket expenses of $7,400. $0 copay on all covered medical expenses until $7,400 has been reached. Then, 100% coverage. This plan does not include drug benefits.

WellCare TexasPlus Choice – $0 deductible with maximum out-of-pocket expenses of $3,400. 3,349 formulary drugs are available. Inpatient hospital copay is $300 for days 1-6. Outpatient hospital copay is $240. Office visit copays are $0 and $40, while the Urgent Care and ER copays are $35 and $120. Diagnostic tests and procedures have a $0 copay, radiology services are subject to a $0 copay, and outpatient x-rays and lab tests have a $15 and $0 copay. Outpatient mental health therapy visits are subject to $40 copays (group and individual). The skilled nursing facility copay is $0 for days 1-20, and $150 for days 21-100. Hearing and vision exams are covered, subject to policy limits. 30-day prescription drug cost-sharing copays are $0 (Tier 1), $5 (Tier 2), $40 (Tier 3), 35% (Tier 4), and 28% (Tier 5).

WellCare TexasPlus Classic – $0 deductible with maximum out-of-pocket expenses of $3,400. 3,349 formulary drugs are available. Inpatient hospital copay is $275. Outpatient hospital copay is $150-$175. Office visit copays are $0 and $35, while the Urgent Care and ER copays are $25 and $120. Diagnostic tests and procedures have a $0-$25 copay, radiology services are subject to a $0 copay, and outpatient x-rays and lab tests have a $0 copay. Outpatient mental health therapy visits are subject to $20 copays (group and individual). The skilled nursing facility copay is $0 for days 1-20, and $100 for days 21-100. Hearing and vision exams are covered, subject to policy limits. 30-day prescription drug cost-sharing copays are $0 (Tier 1), $5 (Tier 2), $40 (Tier 3), $80 (Tier 4), and 33% (Tier 5).

SeniorCare Select – Value Rx – $285 deductible with maximum out-of-pocket expenses of $6,700. 3,413 formulary drugs are available. Inpatient hospital copay is $375 for days 1-5. Outpatient hospital copay is 20%. Office visit copays are $20 and $50, while the Urgent Care and ER copays are $40 and $200. Diagnostic tests and procedures, radiology services, and outpatient x-rays and lab tests are subject to 20% coinsurance. Outpatient mental health therapy visits are subject to $15 copays (group and individual). The skilled nursing facility copay is $0 for days 1-20, and $125 for days 21-100. Hearing and vision exams are covered, subject to policy limits. 30-day prescription drug cost-sharing copays are $6 (Tier 1), $20 (Tier 2), $47 (Tier 3), $100 (Tier 4), and 27% (Tier 5).

Vital Traditions – $200 deductible with maximum out-of-pocket expenses of $4,300. 3,413 formulary drugs are available. Inpatient hospital copay is $275 for days 1-5. Outpatient hospital copay is $275 or 20% per visit. Office visit copays are $0 and $45, while the Urgent Care and ER copays are $50 and $80. Diagnostic tests, procedures, and radiology services are subject to $0-$250 copays. Outpatient mental health therapy visits are subject to $40 copay (group and individual). Foot, hearing, and vision exams are covered, subject to policy limits. 30-day prescription drug cost-sharing copays are $2 (Tier 1), $12 (Tier 2), $47 (Tier 3), $99 (Tier 4), and 29% (Tier 5).

Medicare Prescription Drug Plans (Part D)

Blue Cross MedicareRx Basic – $64.10 per month with $505 deductible and 2,974 available formulary drugs. 3.5-Star Rating by CMS. 30-day preferred pharmacy copays are $1 (Tier 1), $4 (Tier 2), $30 (Tier 3), and 34% (Tier 4). 90-day preferred pharmacy copays are $3 (Tier 1), $12 (Tier 2), $90 (Tier 3), and 34% (Tier 4). 15,015 statewide members.

Blue Cross MedicareRx Value – $95.70 per month with $505 deductible and 3,516 available formulary drugs. 3.5-Star Rating by CMS. 30-day preferred pharmacy copays are $1 (Tier 1), $5 (Tier 2), $45 (Tier 3), and 32% (Tier 4). 90-day preferred pharmacy copays are $3 (Tier 1), $15 (Tier 2), $135 (Tier 3), and 32% (Tier 4). 29,408 statewide members.

Blue Cross MedicareRx Choice – $16.40 per month with $505 deductible and 3,213 available formulary drugs. 3.5-Star Rating by CMS. 30-day preferred pharmacy copays are $0 (Tier 1), $4 (Tier 2), $42 (Tier 3), and 29% (Tier 4). 90-day preferred pharmacy copays are $0 (Tier 1), $12 (Tier 2), $126 (Tier 3), and 29% (Tier 4). 19,607 statewide members.

Humana Walmart Value Rx – $22.70 per month with $480 deductible and 3,184 available formulary drugs. 4.0-Star Rating by CMS. 30-day preferred pharmacy copays are $1 (Tier 1), $4 (Tier 2), 16% (Tier 3), and 41% (Tier 4). 90-day preferred pharmacy copays are $3 (Tier 1), $12 (Tier 2), 16% (Tier 3), and 41% (Tier 4).

Humana Premier Rx – $73.60 per month with $480 deductible and 3,242 available formulary drugs. 3.5-Star Rating by CMS. 30-day preferred pharmacy copays are $1 (Tier 1), $4 (Tier 2), $45 (Tier 3), and 49% (Tier 4). 90-day preferred pharmacy copays are $3 (Tier 1), $12 (Tier 2), $135 (Tier 3), and 49% (Tier 4).

Humana Basic Rx – $23.90 per month with $480 deductible and 3,060 available formulary drugs. 3.5-Star Rating by CMS. 30-day preferred pharmacy copays are $0 (Tier 1), $1 (Tier 2), 19% (Tier 3), and 43% (Tier 4). 90-day preferred pharmacy copays are $0 (Tier 1), $3 (Tier 2), 19% (Tier 3), and 43% (Tier 4).

Elixir RxPlus – $72.50 per month with $480 deductible and 3,133 available formulary drugs. 3.0-Star Rating by CMS. 30-day preferred pharmacy copays are $1 (Tier 1), $6 (Tier 2), $43 (Tier 3), and 45% (Tier 4). 90-day preferred pharmacy copays are $3 (Tier 1), $18 (Tier 2), $129 (Tier 3), and 45% (Tier 4).

Elixir RxSecure – $25.00 per month with $480 deductible and 3,062 available formulary drugs. 3.0-Star Rating by CMS. 30-day preferred pharmacy copays are $1 (Tier 1), $4 (Tier 2), 15% (Tier 3), and 30% (Tier 4). 90-day preferred pharmacy copays are $3 (Tier 1), $28 (Tier 2), 15% (Tier 3), and 30% (Tier 4).

SilverScript Choice – $23.70 per month with $480 deductible and 3,082 available formulary drugs. 3.5-Star Rating by CMS. 30-day preferred pharmacy copays are $0 (Tier 1), $5 (Tier 2), 17% (Tier 3), and 38% (Tier 4). 90-day preferred pharmacy copays are $0 (Tier 1), $15 (Tier 2), 17% (Tier 3), and 38% (Tier 4).

SilverScript Plus – $68.20 per month with $0 deductible and 3,252 available formulary drugs. 3.5-Star Rating by CMS. 30-day preferred pharmacy copays are $0 (Tier 1), $2 (Tier 2), $47 (Tier 3), and 50% (Tier 4). 90-day preferred pharmacy copays are $0 (Tier 1), $0 (Tier 2), $120 (Tier 3), and 50% (Tier 4).

SilverScript SmartRx – $6.90 per month with $480 deductible and 3,578 available formulary drugs. 3.5-Star Rating by CMS. 30-day preferred pharmacy copays are $1 (Tier 1), $19 (Tier 2), $46 (Tier 3), and 49% (Tier 4). 90-day preferred pharmacy copays are $3 (Tier 1), $57 (Tier 2), $138 (Tier 3), and 49% (Tier 4).

Cigna Extra Rx – $63.10 per month with $100 deductible and 3,231 available formulary drugs. 3.5-Star Rating by CMS. 30-day preferred pharmacy copays are $4 (Tier 1), $10 (Tier 2), $42 (Tier 3), and 50% (Tier 4). 90-day preferred pharmacy copays are $12 (Tier 1), $30 (Tier 2), $126 (Tier 3), and 50% (Tier 4).

Cigna Essential Rx – $38.80 per month with $480 deductible and 3,134 available formulary drugs. 3.5-Star Rating by CMS. 30-day preferred pharmacy copays are $0 (Tier 1), $6 (Tier 2), 18% (Tier 3), and 50% (Tier 4). 90-day preferred pharmacy copays are $0 (Tier 1), $18 (Tier 2), 18% (Tier 3), and 50% (Tier 4).

Cigna Secure Rx – $23.10 per month with $480 deductible and 3,143 available formulary drugs. 3.5-Star Rating by CMS. 30-day preferred pharmacy copays are $1 (Tier 1), $3 (Tier 2), $45 (Tier 3), and 47% (Tier 4). 90-day preferred pharmacy copays are $3 (Tier 1), $9 (Tier 2), $135 (Tier 3), and 47% (Tier 4).

WellCare Classic – $21.70 per month with $480 deductible and 3,110 available formulary drugs. 3.5-Star Rating by CMS. 30-day preferred pharmacy copays are $0 (Tier 1), $7 (Tier 2), $38 (Tier 3), and 39% (Tier 4). 90-day preferred pharmacy copays are $0 (Tier 1), $21 (Tier 2), $114 (Tier 3), and 39% (Tier 4).

WellCare Medicare Rx Value Plus – $69.00 per month with $0 deductible and 3,464 available formulary drugs. 3.5-Star Rating by CMS. 30-day preferred pharmacy copays are $0 (Tier 1), $4 (Tier 2), $47 (Tier 3), and 50% (Tier 4). 90-day preferred pharmacy copays are $0 (Tier 1), $12 (Tier 2), $141 (Tier 3), and 50% (Tier 4).

WellCare Value Script – $12.90 per month with $480 deductible and 3,450 available formulary drugs. 3.5-Star Rating by CMS. 30-day preferred pharmacy copays are $0 (Tier 1), $4 (Tier 2), $42 (Tier 3), and 47% (Tier 4). 90-day preferred pharmacy copays are $0 (Tier 1), $12 (Tier 2), $126 (Tier 3), and 47% (Tier 4).

AARP MedicareRx Walgreens– $31.90 per month with $445 deductible and 3,122 available formulary drugs. 3.5-Star Rating by CMS. 30-day preferred pharmacy copays are $0 (Tier 1), $6 (Tier 2), $40 (Tier 3), and 40% (Tier 4). 90-day preferred pharmacy copays are $0 (Tier 1), $18 (Tier 2), $120 (Tier 3), and 40% (Tier 4).

AARP MedicareRx Saver Plus– $44.30 per month with $445 deductible and 3,158 available formulary drugs. 3.5-Star Rating by CMS. 30-day preferred pharmacy copays are $1 (Tier 1), $8(Tier 2), $38 (Tier 3), and 40% (Tier 4). 90-day preferred pharmacy copays are $3 (Tier 1), $24 (Tier 2), $114 (Tier 3), and 40% (Tier 4).

AARP MedicareRx Preferred– $85.10 per month with $0 deductible and 3,566 available formulary drugs. 3.5-Star Rating by CMS. 30-day preferred pharmacy copays are $5 (Tier 1), $10 (Tier 2), $45 (Tier 3), and 40% (Tier 4). 90-day preferred pharmacy copays are $15 (Tier 1), $30 (Tier 2), $135 (Tier 3), and 40% (Tier 4).

Mutual Of Omaha Rx Plus – $83.80 per month with $445 deductible and 2,937 available formulary drugs. 30-day preferred pharmacy copays are $0 (Tier 1), $2 (Tier 2), 20% (Tier 3), and 36% (Tier 4). 90-day preferred pharmacy copays are $0 (Tier 1), $6 (Tier 2), 20% (Tier 3), and n/a (Tier 4).

Mutual Of Omaha Rx Premier – $23.60 per month with $445 deductible and 2,981 available formulary drugs. 30-day preferred pharmacy copays are $0 (Tier 1), $2 (Tier 2), 23% (Tier 3), and 45% (Tier 4). 90-day preferred pharmacy copays are $0 (Tier 1), $6 (Tier 2), 23% (Tier 3), and n/a (Tier 4).

Short-Term Texas Options (Under Age 65)

If you only need coverage for a few months (and possibly as long as 12 months), a temporary policy may be appropriate. Although a deductible must be met before most expenses are paid, this type of contract provides quick benefits if needed (policy approved within 24 hours) and a 10-minute application. Rates are also extremely cheap, and several carriers offer coverage. Shown below are monthly rates for different scenarios.

Male Age 30 Harris County

$109 – Companion Life $5,000 deductible

$142 – Independence American $5,000 deductible

$148 – Everest $5,000 deductible

$173 – Everest $2,500 deductible

$179 – Companion Life $2,000 deductible

Female Age 40 Harris County

$187 – Companion Life $5,000 deductible

$223 – Independence American $5,000 deductible

$246 – Everest $5,000 deductible

$289 – Everest $2,500 deductible

$317 – Companion Life $2,000 deductible

Married Couple (2 Persons) Age 30 Tarrant County

$77 – LifeShield $7,500 deductible

$83 – LifeShield $5,000 deductible

$101 – LifeShield $2,500 deductible

$162 – IHC Group $2,500 deductible

Married Couple (2 Persons) Age 50 Tarrant County

$176 – LifeShield $7,500 deductible

$191 – LifeShield $5,000 deductible

$237 – LifeShield $2,500 deductible

$309 – LifeShield $1,000 deductible

Male Age 35 Dallas County

$112 – Companion Life $5,000 deductible

$135 – Independence American $5,000 deductible

$177 – Everest $2,500 deductible

$89 – UnitedHealthcare $2,500 deductible

Female Age 45 Dallas County

$177 – Companion Life $5,000 deductible

$236 – Independence American $5,000 deductible

$301 – Companion Life $2,000 deductible

$304 – UnitedHealthcare $2,500 deductible

Beware Of Scams

The Affordable Care Act helps many individuals and families in the Lone Star state cut their medical insurance costs. Although the ACA Legislation is more than five years old, the scammers always seem to show up, hoping for opportunities to make an illegal buck. Based on our more than 35 years of experience, we listed below a few of our best tips to keep you safe:

Do not talk to someone who suddenly appears at your front door. Unless you are expecting a broker that you previously set up an appointment with, there is no reason for anyone to visit you unannounced. Also, beware of unexpected phone calls mysteriously requesting to “verify information” for a subsidy. If you receive that type of call, simply hang up.

Do not give out your social security number over the telephone. Typically, if needed, you can provide it, when requested, on an online application. But it generally is not needed until an actual application begins. It is not needed to secure a free quote.

Be wary of any “fees” or “service charges” you are asked to pay. Whether you are getting a quote, getting advice, comparing plans or buying a policy, there is no reason for you to have to pay any money for those services. It doesn’t matter what part of the state you live in (Dallas, San Antonio, etc…) this rule applies to all areas.

If you are told that you “must buy this policy today or the rate will go up,” there’s a good chance that is not true. Although there are specific Exchange Enrollment deadlines, typically, the rates do not change from one day to the next. It is true that prices often tend to increase, but you will usually have 30-90 days to prepare for any increases.

“Navigators” can not sell health insurance. Licensed agents and brokers can. So if a navigator attempts to collect money for a policy, immediately decline the request and report them immediately.

Deadlines (Under Age 65)

November 1 – Open Enrollment begins for Jan 1 effective dates. However, you can shop and compare policies before that date and it is strongly encouraged.

January 15 – Open Enrollment ends. You will be able to apply for a policy under specific circumstances such as loss of job, divorce, reaching age 26, moving out of your service area, etc…

Texas Health Insurance Exchange rates are published and affordable plans are being offered. Marketplace subsidies can drastically reduce premiums for both individuals and families. Our quotes are free and broker expert guidance is always available, if needed.

Companies Offering Marketplace Plans

Many carriers offer policies for individuals and families. Only two other states offer more company choices. It’s also possible that in the future, additional companies will file a request with the Department of Insurance to market their plans. Listed below (in alphabetical order) are the approved carriers.

Ambetter – From Superior Health Plan, is not one of the biggest companies, but they have been expanding in many states. Dental and vision are available riders, and the provider network is picking up new physicians and facilities each year. Prices are typically very competitive.

Blue Cross And Blue Shield – The biggest insurer in the state, BCBS has been writing policies for more than 80 years. As a customer-owned carrier, plan selection is large and many affordable policies are available in most parts of the state.

Cigna – Another large national company that was formed when Connecticut General and INA merged. Their Bronze Savings 6100 plan is one of their most competitive options.

Community Health Choice – This local (Houston) non-profit company is located on South Loop West, and redistributes its profits back into the community. CHIP and Children’s Medicaid (STAR) are offered along with Marketplace plans. Almost 10,000 physicians and 70 hospitals are in-network along with an affiliation with the Harris Health System.

The Texas Department Of Insurance Helps Regulate Companies

FirstCare – Created in 1985 and still locally-owned, FirstCare provides coverage in more than 100 counties. Ownership of the company is shared by two hospitals – Hendrick Health System and Covenant. A wide array of policy options are offered.

Molina – Molina is a Fortune 500 company that offers coverage in 15 states. Their provider network is naturally not as large as other national carriers such as Aetna and BCBS. Rates are very attractive in many parts of the state, including Dallas.

IdealCare and Oscar also offer qualified plans.

NOTE: Prices are determined by many factors including your “geographical area.” There are 26 specific areas that are used to set rates. The Center For Medicare and Medicaid Services (CMS) establishes a Metropolitan Statistical Area (MSA) that serves as a benchmark for the remainder of the state. The Texas Geographic Rating Area is found here.

Essential Health Benefits

All Marketplace individual and small business plans must contain these 10 benefits. Pre-existing clauses will not apply and no waiting period, extra deductible, copay, or coinsurance can be added to the policy. We have listed below each of the 10 required coverages and a brief description of some of the benefits for individual and family plans:

Ambulatory Patient Services – Includes primary care physician and specialist office visits along with other practitioners (nurses and physician assistants). 60 visits to home healthcare facilities and 25 days in a skilled nursing facility are also included. Transplant donor benefits are covered.

Emergency Services – Transportation by ambulance and the routine expenses associated with an ER visit are covered.

Hospitalization – Typical inpatient hospital services including room and board, physician/surgical expenses, and related costs are typically covered. Additionally, a mastectomy with reconstructive surgery (assuming a minimum stay) are included.

Maternity And Newborn Care – Prenatal, postnatal, delivery and inpatient expenses are included. A minimum maternity stay and coverage for complications must also be included. However, In Vitro Fertilization is not included.

Mental Health And Substance Abuse – Outpatient services up to 25 visits and inpatient services (up to 10 days) are covered. Substance abuse (inpatient and outpatient) are included subject to three incidents in lifetime.

Prescriptions – Four types of drugs are covered. They are: Generic, Preferred Brand, Non-Preferred Brand, and Specialty. Copays, coinsurance and possible deductibles to meet will vary, depending upon the plan. Also included are certain contraceptives, Amino-acid formulas, and drugs considered “off-label.”

Rehabilitative Devices And Services – Durable medical equipment, outpatient rehab and habilitative services, and prosthetic/orthotic devices included. Additional coverage for brain injuries.

Laboratory Testing – Diagnostic testing including x-rays and lab work. Also MRIs, PET and CT scans. NOTE: Network-negotiated pricing can substantially reduce the out-of-pocket costs of these tests.

Wellness and Preventative – Accepted preventative screenings, annual physicals, mammograms, and immunizations are covered at 100%. Common screenings include cardiovascular, prostate, and colon or cervical cancer along with various diabetes tests.

Pediatric Treatment And Services – Annual eye exam with glasses. Dental visit also included. Screening for hearing and surgery (reconstructive) for specific abnormalities.

PAST UPDATES:

The Employee Retirement System of Texas (ERS) has published their health insurance rates for employees not eligible for Medicare, surviving dependents and COBRA. Prices for HealthSelect Medical Advantage and KelseyCare have also been released. Although they are estimates (view all information here), prices will not be higher than the projection.

Expansion of Medicaid was rejected for economic reasons. However, almost 3 million children remain covered by Medicaid, which represents an increase of more than 200,000 since late 2014. Many of these children were originally covered by CHIP, but under ACA legislation, changed to Medicaid.

Rice University’s Baker Institute and the Episcopal Health Foundation reported that the number of Texas residents without medical coverage declined by more than 30%. The study was based on findings from 2013-2015 and focused on persons between the ages of 18 and 64. The decrease is largely attributed to the ACA Legislation and federal subsidies that substantially reduce rates for many households.

Despite the encouraging trend, Texas still has the most uninsured persons in the US and also the highest percentage of citizens without coverage. As expected, upper-income households have a much higher coverage rate.

TX Marketplace rates are increasing. Some carriers and specific plans are seeing price hikes of more than 30%. Of course, other plans will see their cost remain fairly stable. Below, we have posted various company/policy requests. NOTE: These increases must be approved by the Department of Insurance before implemented.

64.7% – Time Individual QHP, LBP

34.1% – Scott And White Catastrophic

32.4% – Scott And White Silver

29.7% – Humana EPOx

22.7% – UnitedHealthcare Off Exchange

19.9% – Blue Cross Blue Shield Blue Advantage HMO

17.2% – Allegian Choice PPO

15.9% – Cigna TX-IND-Local Plus

Humana, one of the nation’s biggest insurers (currently in the process of merging with Aetna), will be working closely with UT Medicine, from the UT Health Science Center School of Medicine. Through the new collaboration, Humana group policyholders will be able to access more than 50 additional primary care physicians in the area.

The concept of “Accountable Care” will be used, which features cost-cutting and quality patient experiences. Treatment is more personalized, with preventative and chronic care treatment emphasized.

Open Enrollment has begun with fewer available companies. We have updated the changes.