Health insurance rates in Tennessee are extremely affordable. Review individual or family medical coverage, and see which plans save you the most money, and provide the coverage you need most. We also calculate the federal subsidy that could reduce your prices and substantially lower your TN premium. Regardless of your income, medical conditions or size of family, there are many low-cost policies that include comprehensive benefits. Typically, rates in the Volunteer State are among the lowest in the US. Medigap coverage is also widely available.

We help you compare the policies that give you the best medical coverage for the lowest cost, and apply and enroll for coverage. During Open Enrollment (which began November 1st for 2020 effective dates), you may qualify for financial assistance that reduces your premium by 60% or more. Any pre-existing conditions you have will be covered. It only takes about 20-25 minutes to enroll in an Exchange policy. Occasionally, your entire premium is paid by the subsidy.

Seniors can review Medicare Supplement and Advantage plan options. Medigap plans can potentially save thousands of dollars in out-of-pocket costs. A separate Open Enrollment period is used for applying or changing policies. This OE period begins on October 15th and ends on January 7th. However, a 7-month window that surrounds your 65th birthday can also be used to choose supplemental coverage. Prescription drug coverage is offered through Part D contracts and many Advantage plans.

Any policy can be terminated by yourself at any time and for any reason. There are no cancellation penalties. For example, if you simply can not afford to pay premiums, become eligible for Medicare (or Medicaid), or obtain group coverage through your employer, discontinuing the policy may be the best choice. If you can not afford the cost of coverage, you are not legally obligated to pay the premium. If you are not replacing the coverage, it’s important to understand the risk of being uninsured, although the tax penalty of 2.5% of household income is no longer a factor. Three years ago, the penalty was eliminated.

2024 Tennessee Requested Rate Changes (Marketplace Plans)

Ambetter – 6.73% Increase

BCBS Of Tennessee – 2.70% Increase

Cigna – 2.59% Increase

Oscar – 0.32% Decrease

UnitedHealthcare – 1.88% Increase

US Health And Life – 12.05% Increase

Your Free Quote

Once you provide your zip code at the top of the page, within minutes, you can view the best options. The average cost of a policy (including subsidies) is now less than $100 per month, a reduction of about 70% compared to previous years. About 80% of residents qualify for financial aid, which fuels most of the savings. However, you can select a non-Obamacare plan that may not be compliant, or an off-Exchange plan that meets ACA requirements, but can not receive financial subsidies. Many policies can be purchased at any time throughout the year.

NOTE: Depending on your household income, you, or another family member may qualify for Medicaid or CHIP. However, you can also choose to decline Medicaid (and CHIP) and purchase an unsubsidized policy from any of the participating companies. You will still receive all mandated and required coverage established by the Affordable Care Act legislation. This includes maternity, mental illness, office visits, prescriptions, and pediatric dental benefits.

We Always Provide The Lowest Available Health Insurance Rates In Tennessee

Policies can also be purchased after an Open Enrollment period has ended. Special exception situations (SEP) allow you to apply without answering medical questions.The most common exemptions occur if you lose your work benefits, get divorced, move to another state, or have a baby. NOTE: Newborns are eligible for the SEP, but not either parent. Children reaching age 26, and covered on a parent’s qualified policy, can also apply.

Short-term plans can also be considered to bridge the gap until the next available period. However, they are not eligible for financial assistance, and are designed to cover larger claims. If you have additional questions about Health Exchange plans, we constantly update a page to bring you the latest information.

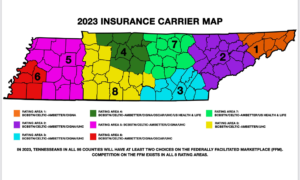

Tennessee Health Exchange Companies

Six companies offer 2024 policies on the Exchange. They are Blue Cross Blue Shield (BCBS), Oscar, Cigna, Ascension, UnitedHealthcare, and Celtic (Ambetter). Additional companies offer “off-Exchange” plans. BCBS has the largest market share, covering about 70% of the state. Group plans through employers are widely available, and feature options from many companies that don’t offer Marketplace policies. UnitedHealthcare offers plans in the western and central portions of the state (Regions 3, 4, 5, and 6). At least two carriers offer plans in all counties.

Community Health Alliance, a CO-OP, previously closed down their operations. Assurant, a subsidiary of Time Insurance, also stopped writing business in all states. Humana, and Aetna pulled out of most states. Depending on future legislation, these two major companies may return to the Marketplace in 2025 or later. Bright Health left the single and family market in the state last year.

More than 70 different plans are available in the four Metal tiers (Platinum, Gold, Silver and Bronze). Low-cost catastrophic policies are offered to persons under age 30 or other applicants that meet “financial hardship” criteria. However, since catastrophic policies are not eligible for the subsidy, we don’t recommend this type of tier contract for low-income households. Often, Bronze or Silver (with cost-sharing) contracts will offer richer benefits at a rate not significantly higher.

2024 TN Marketplace Coverage:

BCBS Of Tennessee – Entire State

Celtic (Ambetter) – Entire State

Cigna – Chattanooga, Jackson, Memphis, Nashville, Knoxville, and Tri-Cities Areas

Oscar – Memphis and Nashville Areas

US Health And Life – Columbia, Dickson, Lawrenceburg, and Nasville Areas

UnitedHealthcare – Chattanooga, Cookeville, Crossville, Jackson, Memphis, Nashville, and Knoxville Areas

Pay A Lot Less With The Subsidy

You can potentially save thousands of dollars each year with the subsidy. Here’s how it works: A tax credit subsidy instantly reduces the cost of your healthcare. Thus, if the monthly rate of the policy is $800 and your subsidy is $700, you only pay $100 per month. And certain plans may even be free! Your subsidy is based upon your household income and the number of dependent persons residing in the household. Cost of coverage and amount of financial aid can vary, depending upon your area of residence.

Your eligibility and amount of money you receive, is also determined by the type of policy selected. Catastrophic plans are not eligible for subsidies. If your income is between 100% and 400% of the Federal Poverty Level (133% in states with Medicaid expansion), you qualify. A few examples are listed below. We’re assuming a household of two adult married persons (ages 45) in the Nashville area (Davidson County). Amounts shown below are your monthly instant tax-credit.

$35,000 household income – $1,129 subsidy

$45,000 household income – $1,044 subsidy

$55,000 household income – $925 subsidy

$60,000 household income – $856 subsidy

$75,000 household income – $661 subsidy

$100,000 household income – $453 subsidy

$125,000 household income – $276 subsidy

$150,000 household income – $99 subsidy

These subsidies are directly applied to the premium. So you do not have to wait or apply to receive the discounts. The amount of subsidy will vary depending on where you live, the size of your family and the modified adjusted gross income (MAGI) you report on your tax return. If your household income substantially changes, a re-calculation of the subsidy is recommended.

For example, if you live in the Nashville area (Shelby County), the amounts increase. Other counties that would provide larger subsidies include Smith, Cumberland, Hawkins, Warren, Madison and Clay. Also, the addition of children in the household will increase financial aid. One extra dependent could make a difference of up to $4,000 per year. NOTE: Eligibility for Medicaid or CHIP may occur in larger families with lower incomes.

Cheapest Health Insurance Plans In Tennessee

Many low-cost policies are available for individuals and families. The least expensive options are listed below. Specific plans may not be offered in all areas.

Catastrophic Tier

Oscar Secure – $9,450 deductible with maximum out-of-pocket expenses of $9,450 and 0% coinsurance. First three pcp office visits are not subject to copay or deductible.

Bronze Tier

BCBS Bronze B15E – $9,450 deductible with maximum out-of-pocket expenses of $9,450 and 0% coinsurance.

BCBS Bronze B16E – $7,500 deductible with maximum out-of-pocket expenses of $9,400 and 50% coinsurance. $50 and $100 office visit copays. $75 Urgent Care copay. $25 generic drug copay. $50 preferred brand drug copay (subject to deductible).

BCBS Bronze B11E – $6,900 deductible with maximum out-of-pocket expenses of $9,100 and 50% coinsurance. $25 pcp office visit copay. $50 Urgent Care copay. Prescription drugs subject to deductible.

BCBS Bronze B07E HSA – $5,950 deductible with maximum out-of-pocket expenses of $7,100 and 50% coinsurance.

BCBS Bronze B08S – $8,700 deductible with maximum out-of-pocket expenses of $8,700 and 0% coinsurance.

BCBS Bronze B16S – $7,500 deductible with maximum out-of-pocket expenses of $9,400 and 50% coinsurance. $50 and $100 office visit copays. $75 Urgent Care copay. $25 generic drug copay. $50 preferred brand drug copay (subject to deductible).

Cigna Connect Bronze 6500 Indiv Med Deductible – $6,500 deductible with $9,450 maximum out-of-pocket expenses and 50% coinsurance.

Cigna Connect Bronze 8500 Indiv Med Deductible – $8,500 deductible with $9,450 maximum out-of-pocket expenses and 50% coinsurance. $25 and $100 office visit copays and $3 preferred generic drug copay ($9 mail order). $55 Urgent Care copay.

Cigna Connect Bronze CMS Standard – $7,500 deductible with $9,400 maximum out-of-pocket expenses and 50% coinsurance. $50 and $100 office visit copays and $25 generic drug copay ($75 mail order). $75 Urgent Care copay.

Cigna Connect Bronze 5500 Indiv Med Deductible – $5,500 deductible with $9,450 maximum out-of-pocket expenses and 50% coinsurance. $50 pcp office visit copay and $3 preferred generic drug copay ($9 mail order). $75 Urgent Care copay.

Oscar Bronze Simple 2 – $9,100 deductible with $9,100 maximum out-of-pocket expenses and 0% coinsurance.

Oscar Bronze Simple Standard – $9,100 deductible with $9,100 maximum out-of-pocket expenses and 40% coinsurance. $75 Urgent Care copay. $3 and $30 generic drug copays (Tiers 1A and 1B).

Oscar Bronze Classic Standard – $7,500 deductible with $9,400 maximum out-of-pocket expenses and 50% coinsurance. $50 and $100 office visit copays. $75 Urgent Care copay. $25 generic drug copay.

Oscar Bronze Classic – PCP Saver Plus – $8,500 deductible with $9,100 maximum out-of-pocket expenses and 50% coinsurance. $50 and $90 office visit copays. $75 Urgent Care copay. $3 and $30 generic drug copays (Tiers 1 and 2).

Ambetter Expanded Bronze Select – $7,500 deductible with $9,400 maximum out-of-pocket expenses and 50% coinsurance. $50 and $100 office visit copays. $75 Urgent Care copay. Preferred generic and generic drug copays are $25 ($75 mail order).

Ambetter Standard Expanded Bronze – $7,500 deductible with $9,400 maximum out-of-pocket expenses and 50% coinsurance. $50 and $100 office visit copays. $75 Urgent Care copay. Preferred generic and generic drug copays are $25 ($75 mail order).

Ambetter Everyday Bronze – $8,450 deductible with $9,250 maximum out-of-pocket expenses and 50% coinsurance. $40 and $90 office visit copays. $50 Urgent Care copay. Preferred generic and generic drug copays are $3 and $30 ($9 and $90 mail order).

UnitedHealthcare Bronze Essential – $9,100 deductible with $9,100 maximum out-of-pocket expenses and 0% coinsurance. $3 Tier 1 drug copay.

UnitedHealthcare Bronze Standard – $9,100 deductible with $9,100 maximum out-of-pocket expenses and 0% coinsurance.

US Health And Life Ascension Personalized Care Bronze Plan 2 – $9,100 deductible with $9,100 maximum out-of-pocket expenses and 0% coinsurance. $25 pcp office visit copay. $15 generic drug copay.

US Health And Life Ascension Personalized Care Bronze Plan 1 – $8,000 deductible with $9,100 maximum out-of-pocket expenses and 50% coinsurance. $50 and $100 office visit copays. $20 generic drug copay.

US Health And Life Ascension Personalized Care Standard Expanded Bronze Plan – $7,500 deductible with $9,000 maximum out-of-pocket expenses and 50% coinsurance. $50 (deductible does not apply) and $100 office visit copays. $25 and $50 copays for generic and preferred brand drugs. $75 Urgent Care copay.

Silver Tier

BCBS Of Tennessee Silver S27L – $5,300 deductible with maximum out-of-pocket expenses of $6,300 and 50% coinsurance. $60 and $120 office visit copays.

BCBS Of Tennessee Silver S24L – $5,150 deductible with maximum out-of-pocket expenses of $8,600 and 50% coinsurance. $35 and $75 office visit copays. Generic, preferred brand, and non-preferred brand drug copays are $60, $100, and $250.

BCBS Of Tennessee Silver S26L – $5,800 deductible with maximum out-of-pocket expenses of $8,900 and 40% coinsurance. $40 and $80 office visit copays. Generic and preferred brand drug copays are $20 and $40. Urgent Care copay.

BCBS Of Tennessee Silver S25L – $0 deductible with maximum out-of-pocket expenses of $4,500 and 50% coinsurance. $45 and $100 office visit copays.

Cigna Connect 4100 – $4,100 deductible with $9,000 maximum out-of-pocket expenses and 40% coinsurance. $20 and $70 office visit copays. $45 Urgent Care copay. Preferred generic and generic drug copays are $0 and $20. Mail order copays are $0 and $60.

Cigna Connect 5800 – $5,800 deductible with $8,900 maximum out-of-pocket expenses and 40% coinsurance. $25 and $75 office visit copays. $35 Urgent Care copay. Generic and preferred brand drug copays are $20 and $40 ($60 and $120 mail order).

Cigna Connect 5450 – $5,450 deductible with $8,950 maximum out-of-pocket expenses and 40% coinsurance. $15 and $65 office visit copays. $35 Urgent Care copay. Generic and preferred brand drug copays are $20 and $75 ($60 and $225 mail order).

Oscar Silver Simple – $6,450 deductible with $8,700 maximum out-of-pocket expenses and 50% coinsurance. Office visit copays are $40, and the Urgent Care copay is $75. Generic and preferred brand drug copays are $3 and $75 ($9 and $225 for 90-day mail order).

Oscar Silver Classic – $5,750 deductible with $8,700 maximum out-of-pocket expenses and 50% coinsurance. Office visit copays are $35 and $95, and the Urgent Care copay is $50. Generic and preferred brand drug copays are $3 and $100 ($9 and $300 for 90-day mail order). X-ray and lab work x-rays are $95 and $10.

Ambetter Balanced Care 12 – $6,500 deductible with $8,400 maximum out-of-pocket expenses and 40% coinsurance. Office visit copays are $35 and $70, and the Urgent Care copay is $55. $35 copay for outpatient lab services. Generic and preferred brand drug copays are $25 and $60 ($62.50 and $150 for 90-day mail order).

Ambetter Balanced Care 11 – $6,000 deductible with $8,500 maximum out-of-pocket expenses and 40% coinsurance. Office visit copays are $30 and $60, and the Urgent Care copay is $60. $30 copay for outpatient lab services. Generic and preferred brand drug copays are $20 and $55 ($50 and $137.50 for 90-day mail order).

Ambetter Balanced Care 29 – $5,450 deductible with $8,650 maximum out-of-pocket expenses and 35% coinsurance. Pcp office visit copay is $25, and the Urgent Care copay is $60. Generic and preferred brand drug copays are $5/$25 and $75 ($12.50/$62.50 and $187.50 for 90-day mail order). $40 copay for lab tests.

Ambetter Balanced Care 30 – $6,100 deductible with $6,100 maximum out-of-pocket expenses and 0% coinsurance.

Ambetter Balanced Care 31 – $5,450 deductible with $6,450 maximum out-of-pocket expenses and 10% coinsurance. $60 Urgent Care copay.

Ambetter Balanced Care 32 – $8,100 deductible with $8,700 maximum out-of-pocket expenses and 50% coinsurance. Office visit copays are $45 and $100, and the Urgent Care copay is $60. $50 copay for outpatient lab services. Generic and preferred brand drug copays are $25 and $75 ($62.50 and $187.50 for 90-day mail order).

Bright Health Silver 5000 Plan – $5,000 deductible with $8,700 maximum out-of-pocket expenses and 40% coinsurance. Office visit copays are $40 ($0 first three pcp visits) and $80, and the Urgent Care copay is $50. Preferred generic, generic, preferred brand, and non-preferred brand drug copays are $0, $30, $150, and $250. Lab and x-ray copays are $50 and $100.

Bright Health Silver 4000 Plan – $4,000 deductible with $8,700 maximum out-of-pocket expenses and 40% coinsurance. $35 pcp office visit copay, and the Urgent Care copay is $50. Preferred generic drug copay is $15. Lab and x-ray copays are $50 and $100.

Bright Health Silver 3000 Plan – $3,000 deductible with $8,700 maximum out-of-pocket expenses and 40% coinsurance. Office visit copays are $35 ($0 first three pcp visits) and $70, and the Urgent Care copay is $50. Preferred generic, generic, preferred brand, and non-preferred brand drug copays are $0, $30, $150, and $250. Lab and x-ray copays are $50 and $100.

UnitedHealthcare Silver Value+ Saver – $6,100 deductible with $8,700 maximum out-of-pocket expenses and 40% coinsurance. First three pcp office visits subject to $0 copay. $35 and $100 office visit copays. $75 Urgent Care copay. $3 and $30 drug copays (Tiers 1 and 2). Tier 3 drug copay is $85.

Gold Tier

Ambetter Secure Care 5– $1,450 deductible with $6,300 maximum out-of-pocket expenses and 20% coinsurance. Office visit copays are $15 and $35, and the Urgent Care copay is $35. Generic and preferred brand drug copays are $15 and $30 ($37.50 and $75 for mail order). $15 copay for some diagnostic testing.

BCBS Of Tennessee Gold G07S – $1,000 deductible with maximum out-of-pocket expenses of $6,000 and 45% coinsurance. $10 pcp office visit copay (Sanitas). Urgent Care copay is $50 (Sanitas). Prescription drugs subject to coinsurance.

Cigna Connect 1000 – $1,000 deductible with $6,500 maximum out-of-pocket expenses and 30% coinsurance. $15 and $60 office visit copays with $50 Urgent Care copay. Preferred, non-preferred generic, and preferred brand drug copays are $10, $15, and $50. 90-day mail order copays are $30, $45, and $150.

Bright Health Gold – $1,000 deductible with $8,550 maximum out-of-pocket expenses and 20% coinsurance. Office visit copays are $20 ($0 first two visits) and $40, and the Urgent Care copay is $50. Generic and preferred brand drug copays are $10 and $50. Non-preferred drug copay is $125. ER copay is $500.

Oscar Gold Classic – $2,500 deductible with $6,000 maximum out-of-pocket expenses and 30% coinsurance. Office visit copays are $30 and $55, and the Urgent Care copay is $75. Generic and preferred brand drug copays are $3 and $55 ($9 and $165 for 90-day mail order). Tier 1B drug copays are $30 and $90.

UnitedHealthcare Value Gold – $2,350 deductible with $8,550 maximum out-of-pocket expenses and 20% coinsurance. Office visit copays are $20 and $65, and the Urgent Care copay is $75. Tier 1, Tier2, and Tier 3 drug copays are $6, $12, and $50.

Chattanooga Rates Are Among The Lowest In The US

Yes…Chattanooga medical plan prices are incredibly low, along with many other areas in the eastern part of the state. You can thank Blue Cross Blue Shield who negotiates lower pricing with a local hospital system. The result has been prices for coverage that are extremely attractive. Currently, Oscar and Bright Health do not offer coverage in this area, and the number of available plans is limited, prices remain competitive.

Although Hamilton County has its share of smokers, high blood pressure, obese persons, and serious medical issues, the Erlanger Health System network is able to provide enough doctors and hospitals to treat everyone. And whether it’s an MRI or an ER visit, the cost of treatment is not breaking the bank. Blue Cross identifies its networks with letter designations. For example, the “E” network has the least number of providers (including only one local hospital). “S” policies have two available hospitals in the area while “P” plans allow access to three.

Shown below are monthly Chattanooga rates for a married couple (both age 40) with household income of $50,000:

Ambetter Essential Care 1 – $48

BCBS Bronze B08S – $60

Cigna Connect 8550 – $87

Cigna Connect 6500 – $89

Ambetter Essential Care 2 – $110

Nonprofit Cooperatives No Longer Available

Although not very popular and relatively new, nonprofit cooperatives were available in several states including Tennessee. The advantage (sometimes) was price, although the network provider list was typically very shallow. Community Health Alliance enrolled less than 400 persons during the initial Open Enrollment period, far short than original expectations. The following year was better but not enough to keep the struggling CO-OP operating.

More than 25,000 policyholders were forced to find other plans four years ago. Even though a 44% rate increase was approved, the risk of failure was too large to allow operations to continue. Created by a bipartisan group of Congress, “Cooperatives” were intended to give consumers another option for purchasing low-cost medical coverage. All profits are dispersed back into the organization with the main focus on patient-care. It’s possible that they could return after 2019, depending upon new legislative guidelines.

Knoxville Makes List Of Most Affordable Cities

The widely respected Kaiser News Department recently published the 10 areas of the US with the best healthcare bargains. As expected, Western Pennsylvania, Hawaii and parts of Minnesota made the list. But so did Knoxville, checking in at Number eight! One of the reasons may be that Blue Cross and Blue Shield was able to negotiate an agreement with a single hospital system.

Also, Knoxville has several highly-rated hospitals that effectively service the community, and their close proximity may play a role in keeping rates affordable. These hospitals include Turkey Creek Medical Center, Est TN Children’s, Fort Sanders Regional Medical Center, Parkwest, Physician’s Regional, North Knoxville Medical Center, and the UT Medical Center.

What About Nashville?

The Nashville area (including Davidson County) also offers low rates. We have listed below some examples of the most competitive policy options for that area. Our assumption is based on a 45-year old couple with total income of $50,000 per year, resulting in an annual subsidy of more than $9,000. Prices shown below are monthly, and the federal subsidy has been applied to the premium. Also, “cost-sharing” applies to Silver-tier plans.

$41 – Ambetter Essential Care 1

$59 – BCBS Bronze B08S – $60

$67 – Cigna Connect 8550

$70 – Cigna Connect 6500

$81 – Bright Health Bronze 8550

$92 – UnitedHealthcare Balance Bronze 3 Free Visits

$93 – UnitedHealthcare Value Bronze

What If I Don’t Qualify For The Subsidy?

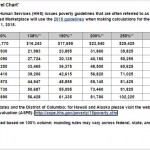

If your income is too high to qualify for the federal subsidy, affordable plans are still available. For example, based on the most current Federal Poverty Guidelines, if your income exceeds the amounts listed below (courtesy of Heritage), you would become ineligible for subsidies. The maximum household amounts are $12,140 for one person, $16,460 for two persons, $20,780 for three persons, and $25,100 for four persons. Click the graph to enlarge.

Tennessee Federal Poverty Level Guidelines For Marketplace Plans

When applying and purchasing coverage with no Obamacare subsidy, the government website is not involved (off-Exchange). Admittedly, the process is sometimes quicker, with very few glitches, delays, or frustration. We help you compare plans, evaluate what impact your medical conditions (if you have any) have on your potential out-of-pocket expenses, and finally select the best option.

Often, when off-Exchange (off-Marketplace) policies are purchased, your network provider list is larger, and discounts on services are greater. This difference started to appear when carriers realized that creating thinner networks were the only way to remain competitive while offering guarantee-issue (non-underwriting) plans.

Since Open Enrollment (OE) occurs every year in Tennessee and all other states, you are never locked into a choice. For example, if you select a cheap high-deductible policy with large out-of-pocket costs, and realize you will have major medical expenses the following year, you can change to a lower out-of-pocket cost plan. Typically, OE occurs at the end of the calendar year (November 1-December 15). If coverage needs to be purchased outside of these dates, other plans are available. In a few years, new low-cost options may be introduced that provide plans without several of the 10 “essential health benefits.” Senior Medicare plan Open Enrollment begins in October.

Cheap Tennessee health insurance plans are available and our job is to help you find them. With the help of expert advice, federal subsidies and comprehensive comparisons, we make it easy to find the most affordable policies. If you are currently being treated for chronic medical conditions, many comprehensive options are offered.

Where Do Tennessee Residents Get Their Health Insurance?

Shown below are the Kaiser Family Foundation’s most recent research statistics.

All Residents

Employer – 47%

Medicaid – 21%

Medicare – 15%

No Coverage – 10%

Non-Group – 6%

Military – 1%

Ages 0-64

Employer – 55%

Medicaid – 22%

No Coverage – 12%

Non-Group – 7%

Medicare – 2%

Military – 2%

Ages 0-18

Employer – 45%

Medicaid – 43%

Non-Group – 5%

No Coverage – 5%

Public – 2%

Ages 19-64

Employer – 58%

No Coverage – 15%

Medicaid – 14%

Non-Group – 8%

Medicare – 3%

Military – 2%

Adults And Dependent Children

Employer – 60%

Medicaid – 19%

No Coverage – 12%

Non-Group – 6%

Military – 2%

Medicare – 1%

Adults And No Dependent Children

Employer – 57%

No Coverage – 16%

Medicaid – 12%

Non-Group – 9%

Medicare – 4%

Military – 2%

Women Ages 19-64

Employer – 57%

Medicaid – 17%

No Coverage – 13%

Non-Group – 8%

Medicare – 3%

Military – 2%

Men Ages 19-64

Employer – 59%

No Coverage – 17%

Medicaid – 11%

Non-Group – 7%

Medicare – 3%

Military – 3%

Tennessee Medicare Supplement Plans For Seniors

More than 1 million Volunteer State residents receive Medicare benefits, and about one fourth also qualify for Medicaid. Additional assistance is provided the State Government. They are the Commission on Aging And Disability, Medicare Assistance, and Department of Human Services.

Medigap/Supplement plans pay many of the out-of-pocket costs that standard Medicare coverage does not cover. Some of the most common expenses are Part A coinsurance and hospital costs, Part B coinsurance and co-payments, Part A and B deductibles, Part B excess charges, skilled nursing facility care coinsurance, blood, and other costs. Policies are issued individually, so it is possible for each spouse to enroll in a different plan. The Department of Insurance (DOI) helps to verify the financial safety of companies conducting business in the state.

Listed below are current estimated monthly rates (Female Age 65) for various popular plans:

Shelby, Fayette, Hardeman, Tipton, Dyer, And Lake Counties

Plan A

$72 – AARP-UnitedHealthcare

$77 – Accendo

$83 – Continental Life

$84 – United World Life

$89 – New Era Life

$89 – Humana

$90 – Capitol Life

$90 – United States Fire

$93 – Union Security

$94 – Great Southern Life

$97 – Lumico Life

$104 – Thrivent

$105 – Cigna

$116 – Oxford Life

$121 – Medico

Plan F (HD)

$34 – Cigna

$34 – Great Southern Life

$35 – New Era Life

Plan F

$105 – Humana

$108 – Accendo

$109 – Continental Life

$110 – Union Security

$112 – United World Life

$113 – Capitol Life

$115 – United States Fire

$117 – New Era Life

$117 – Lumico Life

$117 – Great Southern Life

$127 – AARP-UnitedHealthcare

$132 – Thrivent

$161 – Cigna

$197 – Medico

$227 – Oxford Life

Plan G

$96 – Western United Life

$97 – New Era Life

$101 – Lumico Life

$102 – Humana

$103 – Thrivent

$103 – AARP-UnitedHealthcare

$104 – Cigna

$106 – Guarantee Trust Life

$106 – Aetna

$108 – Americo

$118 – Oxford Life

$119 – Mutual Of Omaha

$140 – Medico

$205 – Gerber

Plan N

$76 – Aetna

$81 – Western United Life

$83 – Thrivent

$84 – Cigna

$87 – Guarantee Trust Life

$87 – Lumico Life

$88 – Humana

$89 – Americo

$91 – AARP-UnitedHealthcare

$93 – Mutual Of Omaha

$103 – New Era Life

$104 – Medico

$118 – Oxford Life

Davidson County

Plan A

$72 – AARP-UnitedHealthcare

$77 – Accendo

$77 – Continental Life

$84 – United World Life

$89 – Humana

$95 – Lumico Life

$97 – New Era Life

$99 – Western United Life

$100 – Medico

$101 – Great Southern Life

$105 – Union Security

$106 – Cigna

$111 – Oxford Life

$114 – Guarantee Trust Life

$118 – Thrivent

Plan C

$127 – AARP-UnitedHealthcare

$135 – Western United Life

Plan F (HD)

$36 – Great Southern Life

Plan F

$106 – Humana

$108 – Accendo

$109 – Continental Life

$112 – United World Life

$122 – Lumico Life

$124 – Capitol Life

$125 – Union Security

$127 – Great Southern Life

$127 – AARP-UnitedHealthcare

$144 – Western United Life

$150 – Thrivent

$157 – Medico

$218 – Oxford Life

Plan G (HD)

$33 – United World Life

$36 – Continental Life

$36 – United States Fire

Plan N

$70 – Humana

$70 – Accendo

$71 – Continental Life

$71 – United World Life

$75 – Capitol Life

$75 – Western United Life

$76 – United States Fire

$81 – Lumico Life

$82 – Union Security

$86- AARP-UnitedHealthcare

$87 – Great Southern Life

$88 – Thrivent

$90 – Medico

$103 – Cigna

$124 – Oxford Life

Tennessee Medicare Advantage Plans For Seniors

2024 Medicare Advantage plans in Tennessee are also popular because of low premiums and comprehensive benefits (including prescription coverage).

MA plans utilize a network of the carrier offering coverage. Additional benefits, including fitness club memberships, transportation to physician office visits, dental, vision, and hearing are often included. Medicare-approved companies provide options in all counties and prescription drug benefits are often included. Your red, white, and blue cards should be retained in case you decide to switch back to conventional coverage.

A pre-determined fixed payment is made to providers. Although out-of-pocket costs can vary from one MA plan to another, many basic required services must be included. Rules for referral requirements and non-emergency/Urgent Care visits can change each year.

Several popular plan options are listed below.

Counties With The Most Available MA Plans

62 – Davidson County

61 – Rutherford County

60 – Williamson County

60 – Sumner County

58 – Wilson County

58 – Robertson County

57 – Hamilton County

57 – Cheatham County

56 – Shelby County

55 – Trousdale County

54 – Hickman County

54 – Giles County

54 – Cannon County

54 – Fayette County

54 – Grundy County

54 – Marion County

54 – Warren County

53 – Sequatchie County

53 – Humphreys County

52 – Cumberland County

52 – Macon County

52 – Jackson County

52 – Lawrence County

52 – Clay County

52 – Bledsoe County

52 – Smith County

Counties With The Least Available MA Plans

38 – McMinn County

39 – Dyer County

40 – Greene County

41 – Obion County

41 – Weakley County

41 – Carter County

41 – Roane County

42 – Lake County

42 – Henderson County

42 – Unicoi County

42 – Claiborne County

43 – Henry County

44 – Hawkins County

44 – Johnson County

44 – Sullivan County

45 – Crockett County

45 – Hancock County

45 – Campbell County

45 – Scott County

46 – Gibson County

46 – McNairy County

46 – Lauderdale County

46 – Hardin County

47 – Perry County

47 – Cocke County

47 – Hardeman County

47 – Grainger County

47 – Pickett County

47 – Jefferson County

47 – Morgan County

47 – Overton County

47 – Sevier County

47 – Stewart County

47 – Union County

Note: Each county features several similar or identical options. However, copays, deductibles, and maximum out-of-pocket expenses can vary, along with the network provider list. Also, most participating insurers do not offer contracts in all areas of the state, and rates may differ from one county to another. Most benefits described below are for in-network treatment. A full comprehensive list of benefits is available for each plan.

AARP Medicare Advantage from UHC TN-0001 – $0 deductible with maximum out-of-pocket expenses of $5,900. Inpatient hospital copay is $295 for first 5 days. Outpatient hospital copay is $0-$295 per visit. Office visit copays are $0 and $0-$35, while the Urgent Care and ER copays are $0-$40 and $120. Diagnostic tests, procedures, outpatient x-rays, and lab tests have a $0-$45 copay. Outpatient mental health therapy visits are subject to $15 copay (group) or $0-$25 copay (individual). Hearing, preventative dental, and vision exams are covered, subject to policy limits. 30-day prescription drug cost-sharing copays are $0 (Tier 1), $10 (Tier 2), $47 (Tier 3), $100 (Tier 4), and 33% (Tier 5). The Plan Summary Star Rating is 3.5. Monthly premium is $0.

AARP Medicare Advantage from UHC TN-0005 – $0 deductible with maximum out-of-pocket expenses of $5,900. Inpatient hospital copay is $295 for first five days. Outpatient hospital copay is $0-$295 per visit. Office visit copays are $0 and $0-$30, while the Urgent Care and ER copays are $0-$40 and $120. Diagnostic tests, procedures, outpatient x-rays, and lab tests have a $0-$45 copay. Outpatient mental health therapy visits are subject to $15 copay (group) or $0-$25 copay (individual). Dental, hearing, and vision exams are covered, subject to policy limits. 30-day prescription drug cost-sharing copays are $0 (Tier 1), $10 (Tier 2), $45 (Tier 3), $95 (Tier 4), and 33% (Tier 5). The Plan Summary Star Rating is 4.5. The monthly premium is $0.

AARP Medicare Advantage from UHC TN-0006 – $0 deductible with maximum out-of-pocket expenses of $3,000. Inpatient hospital copay is $275 for first five days. Outpatient hospital copay is $0-$255 per visit. Office visit copays are $0 and $0-$25, while the Urgent Care and ER copays are $0-$40 and $135. Diagnostic tests, procedures, outpatient x-rays, and lab tests have a $0-$20 copay. Outpatient mental health therapy visits are subject to $15 copay (group) or $0-$25 copay (individual). Dental, hearing, and vision exams are covered, subject to policy limits. 30-day prescription drug cost-sharing copays are $0 (Tier 1), $8 (Tier 2), $45 (Tier 3), $95 (Tier 4), and 33% (Tier 5). The Plan Summary Star Rating is 4.5. The monthly premium is $39.

AARP Medicare Advantage from UHC TC-0004 – $395 deductible with maximum out-of-pocket expenses of $6,300. Inpatient hospital copay is $375 for first five days. Outpatient hospital copay is $0-$375 per visit. Office visit copays are $0 and $0-$45, while the Urgent Care and ER copays are $0-$40 and $120. Diagnostic tests, procedures, outpatient x-rays, and lab tests have a $0-$40 copay. Outpatient mental health therapy visits are subject to $15 copay (group) or $0-$25 copay (individual). Dental, hearing, and vision exams are covered, subject to policy limits. 30-day prescription drug cost-sharing copays are $0 (Tier 1), $14 (Tier 2), $45 (Tier 3), $95 (Tier 4), and 27% (Tier 5). The Plan Summary Star Rating is 4.5. The monthly premium is $0.

AARP Medicare Advantage Rebate – $0 deductible with maximum out-of-pocket expenses of $5,900. Inpatient hospital copay is $375 for first five days. Outpatient hospital copay is $0-$350 per visit. Office visit copays are $0 and $45, while the Urgent Care and ER copays are $40 and $90. Diagnostic tests, procedures, outpatient x-rays, and lab tests have a $0-$20 copay. Outpatient mental health therapy visits are subject to $15 copay (group) or $25 copay (individual). Dental, hearing, and vision exams are covered, subject to policy limits. 30-day prescription drug cost-sharing copays are $0 (Tier 1), $14 (Tier 2), $45 (Tier 3), $95 (Tier 4), and 26% (Tier 5). The Plan Summary Star Rating is 4.5.

AARP Medicare Advantage Patriot – $0 deductible with maximum out-of-pocket expenses of $3,200. Inpatient hospital copay is $175 for first five days. Outpatient hospital copay is $0-$160 per visit. Office visit copays are $0 and $25, while the Urgent Care and ER copays are $40 and $90. Diagnostic tests, procedures, outpatient x-rays, and lab tests have a $0-$15 copay. Outpatient mental health therapy visits are subject to $15 copay (group) or $25 copay (individual). Dental, hearing, and vision exams are covered, subject to policy limits. No prescription drug benefits are included. The Plan Summary Star Rating is 4.5.

Aetna Medicare Premier Plan – $0 deductible with maximum out-of-pocket expenses of $7,500. Inpatient hospital copay is $350 for first four days. Outpatient hospital copay is $0-$300 per visit. Office visit copays are $0 and $40, while the Urgent Care and ER copays are $0-$40 and $90. Diagnostic tests, and procedures have a $0-$75 copay, outpatient x-rays have a $14 copay, and lab tests have a $0 copay. Outpatient mental health therapy visits are subject to $40 copay. Dental, hearing, and vision exams are covered, subject to policy limits. 30-day prescription drug cost-sharing copays are $2 (Tier 1), $5 (Tier 2), $47 (Tier 3), $100 (Tier 4), and 33% (Tier 5).

Aetna Medicare Premier Plus Plan – $0 deductible with maximum out-of-pocket expenses of $6,700. Inpatient hospital copay is $350 for first four days. Outpatient hospital copay is $0-$300 per visit. Office visit copays are $0 and $35, while the Urgent Care and ER copays are $0-$35 and $90. Diagnostic tests, and procedures have a $0-$75 copay, outpatient x-rays have a $14 copay, and lab tests have a $0 copay. Outpatient mental health therapy visits are subject to $40 copay. Dental, hearing, and vision exams are covered, subject to policy limits. 30-day prescription drug cost-sharing copays are $0 (Tier 1), $0 (Tier 2), $47 (Tier 3), $100 (Tier 4), and 33% (Tier 5).

Aetna Medicare Value Plus Plan – $95 deductible with maximum out-of-pocket expenses of $6,700. Inpatient hospital copay is $300 for first five days. Outpatient hospital copay is $0-$300 per visit. Office visit copays are $0 and $25, while the Urgent Care and ER copays are $0-$25 and $90. Diagnostic tests, and procedures have a $0-$75 copay, outpatient x-rays have a $14 copay, and lab tests have a $0 copay. Outpatient mental health therapy visits are subject to $40 copay. Dental, hearing, and vision exams are covered, subject to policy limits. 30-day prescription drug cost-sharing copays are $0 (Tier 1), $5 (Tier 2), $47 (Tier 3), $100 (Tier 4), and 31% (Tier 5).

Aetna Medicare Eagle Plan – $0 deductible with maximum out-of-pocket expenses of $6,700. Inpatient hospital copay is $300 for first five days. Outpatient hospital copay is $0-$250 per visit. Office visit copays are $0 and $35, while the Urgent Care and ER copays are $0-$35 and $90. Diagnostic tests, and procedures have a $0-$75 copay, outpatient x-rays have a $14 copay, and lab tests have a $0 copay. Outpatient mental health therapy visits are subject to $40 copay. Dental, hearing, and vision exams are covered, subject to policy limits. No prescription drug benefits are included.

Amerivantage Classic – $0 deductible with maximum out-of-pocket expenses of $4,900. Inpatient hospital copay is $295 for first six days. Outpatient hospital copay is $0-$285 per visit. Office visit copays are $0 and $35, while the Urgent Care and ER copays are $30 and $90. Diagnostic tests, and procedures have a $0-$150 copay, outpatient x-rays have a $50-$110 copay, and lab tests have a $0-$10 copay. Outpatient mental health therapy visits are subject to $40 copay (group and individual). Dental, hearing, and vision exams are covered, subject to policy limits. 30-day prescription drug cost-sharing copays are $2 (Tier 1), $8 (Tier 2), $42 (Tier 3), $95 (Tier 4), and 33% (Tier 5).

Amerivantage Plus – $0 deductible with maximum out-of-pocket expenses of $5,100. Inpatient hospital copay is $295 for first five days. Outpatient hospital copay is $0-$275 per visit. Office visit copays are $0 and $$0- 40, while the Urgent Care and ER copays are $35 and $80. Diagnostic tests, and procedures have a $0-$150 copay, outpatient x-rays have a $90-$110 copay, and lab tests have a $0-$10 copay. Outpatient mental health therapy visits are subject to $40 copay (group and individual). Dental, hearing, and vision exams are covered, subject to policy limits. 30-day prescription drug cost-sharing copays are $2 (Tier 1), $10 (Tier 2), $42 (Tier 3), $95 (Tier 4), and 33% (Tier 5).

BlueAdvantage Emerald – $0 deductible with maximum out-of-pocket expenses of $5,900. Inpatient hospital copay is $275 for first five days. Outpatient hospital copay is $300 per visit. Office visit copays are $10 and $30, while the Urgent Care and ER copays are $60 and $90. Diagnostic tests, procedures, outpatient x-rays, and lab tests have a $0-$100 copay. Outpatient mental health therapy visits are subject to $20 and $30 copays (group and individual). Dental, hearing, and vision exams are covered, subject to policy limits. 30-day prescription drug cost-sharing copays are $1 (Tier 1), $5 (Tier 2), $35 (Tier 3), $80 (Tier 4), and 33% (Tier 5).

BlueAdvantage Garnet – $0 deductible with maximum out-of-pocket expenses of $6,700. Inpatient hospital copay is $300 for first five days. Outpatient hospital copay is $325 per visit. Office visit copays are $10 and $35, while the Urgent Care and ER copays are $65 and $90. Diagnostic tests, procedures, outpatient x-rays, and lab tests have a $0-$100 copay. Outpatient mental health therapy visits are subject to $20 and $30 copays (group and individual). Dental, hearing, and vision exams are covered, subject to policy limits. 30-day prescription drug cost-sharing copays are $1 (Tier 1), $10 (Tier 2), $42 (Tier 3), $92 (Tier 4), and 33% (Tier 5).

BlueAdvantage Ruby – $0 deductible with maximum out-of-pocket expenses of $4,800. Inpatient hospital copay is $260 for first four days. Outpatient hospital copay is $260 per visit. Office visit copays are $10 and $25, while the Urgent Care and ER copays are $55 and $85. Diagnostic tests, procedures, outpatient x-rays, and lab tests have a $10-$100 copay. Outpatient mental health therapy visits are subject to $20 and $30 copays (group and individual). Dental, hearing, and vision exams are covered, subject to policy limits. 30-day prescription drug cost-sharing copays are $1 (Tier 1), $5 (Tier 2), $28 (Tier 3), $65 (Tier 4), and 33% (Tier 5).

BlueAdvantage Diamond – $0 deductible with maximum out-of-pocket expenses of $3,700. Inpatient hospital copay is $175 for first four days. Outpatient hospital copay is $175 per visit. Office visit copays are $10 and $20, while the Urgent Care and ER copays are $55 and $60. Diagnostic tests, procedures, outpatient x-rays, and lab tests have a $10-$100 copay. Outpatient mental health therapy visits are subject to $10 and $20 copays (group and individual). Dental, hearing, and vision exams are covered, subject to policy limits. 30-day prescription drug cost-sharing copays are $1 (Tier 1), $5 (Tier 2), $28 (Tier 3), 50% (Tier 4), and 33% (Tier 5).

Cigna Fundamental Medicare – $0 deductible with maximum out-of-pocket expenses of $6,700. Inpatient hospital copay is $270 for first five days. Outpatient hospital copay is $0-$150 per visit. Office visit copays are $0 and $30, while the Urgent Care and ER copays are $0 and $90. Diagnostic tests, procedures, outpatient x-rays, and lab tests have a $0-$100 copay. Outpatient mental health therapy visits are subject to $0 copay (group and individual). Dental, hearing, and vision exams are covered, subject to policy limits. No prescription drug benefits are included.

Cigna Preferred Medicare – $0 deductible with maximum out-of-pocket expenses of $6,700. Inpatient hospital copay is $325 for first five days. Outpatient hospital copay is $0-$300 per visit. Office visit copays are $0 and $5, while the Urgent Care and ER copays are $30 and $90. Diagnostic tests, procedures, outpatient x-rays, and lab tests have a $0-$150 copay. Outpatient mental health therapy visits are subject to $0 copay (group and individual). Dental, hearing, and vision exams are covered, subject to policy limits. 30-day prescription drug cost-sharing copays are $0 (Tier 1), $12 (Tier 2), $42 (Tier 3), 50% (Tier 4), and 33% (Tier 5).

Cigna True Choice Medicare – $0 deductible with maximum out-of-pocket expenses of $5,900. Inpatient hospital copay is $295 for first five days. Outpatient hospital copay is $0-$250 per visit. Office visit copays are $0 and $30, while the Urgent Care and ER copays are $55 and $90. Diagnostic tests, procedures, outpatient x-rays, and lab tests have a $0-$100 copay. Outpatient mental health therapy visits are subject to $0 copay (group and individual). Dental, hearing, dental, and vision exams are covered, subject to policy limits. 30-day prescription drug cost-sharing copays are $0 (Tier 1), $4 (Tier 2), $40 (Tier 3), $80 (Tier 4), and 33% (Tier 5).

Cigna Alliance Medicare – $0 deductible with maximum out-of-pocket expenses of $6,700. Inpatient hospital copay is $295 for first five days. Outpatient hospital copay is $0-$300 per visit. Office visit copays are $0 and $30, while the Urgent Care and ER copays are $25 and $90. Diagnostic tests, procedures, outpatient x-rays, and lab tests have a $0-$270 copay. Outpatient mental health therapy visits are subject to $0 copay (group and individual). Dental, hearing, dental, and vision exams are covered, subject to policy limits. 30-day prescription drug cost-sharing copays are $3 (Tier 1), $12 (Tier 2), $42 (Tier 3), 49% (Tier 4), and 33% (Tier 5).

Cigna Preferred Plus Medicare – $0 deductible with maximum out-of-pocket expenses of $4,800. Inpatient hospital copay is $400. Outpatient hospital copay is 0%-5% per visit. Office visit copays are $0 and $25, while the Urgent Care and ER copays are $0 and $90. Diagnostic tests, procedures, outpatient x-rays, and lab tests have a $0 copay. Outpatient mental health therapy visits are subject to $0 copay (group and individual). Dental, hearing, dental, and vision exams are covered, subject to policy limits. 30-day prescription drug cost-sharing copays are $3 (Tier 1), $12 (Tier 2), $42 (Tier 3), 50% (Tier 4), and 33% (Tier 5).

HumanaChoice R7315-001 Regional PPO – $500 deductible with maximum out-of-pocket expenses of $3,400. Inpatient hospital copay is $550 per stay. Outpatient hospital copay is $30-$95 per visit. Office visit copays are $10 and $30, while the Urgent Care and ER copays are $10-$30 and $90. Diagnostic tests, procedures, outpatient x-rays, and lab tests have a $0-$50 copay. Outpatient mental health therapy visits are subject to $30 copay (group and individual). Dental and vision exams are covered, subject to policy limits. No prescription drug benefits are included.

Humana Honor – $0 deductible with maximum out-of-pocket expenses of $3,400. Inpatient hospital copay is $5,900 per stay. Outpatient hospital copay is $35-$175 per visit. Office visit copays are $0 and $35, while the Urgent Care and ER copays are $35 and $90. Diagnostic tests, procedures, outpatient x-rays, and lab tests have a $0-$35 copay. Outpatient mental health therapy visits are subject to $35 copay (group and individual). Dental and vision exams are covered, subject to policy limits. No prescription drug benefits are included.

Humana Gold Plus – $0 deductible with maximum out-of-pocket expenses of $5,900. Inpatient hospital copay is $295 for the first six days. Outpatient hospital copay is $30-$275 per visit. Office visit copays are $0 and $30, while the Urgent Care and ER copays are $30 and $90. Diagnostic tests, procedures, outpatient x-rays, and lab tests have a $0-$50 copay. Outpatient mental health therapy visits are subject to $30 copay (group and individual). Dental, hearing, and vision exams are covered, subject to policy limits. 30-day prescription drug cost-sharing copays are $3 (Tier 1), $12 (Tier 2), $47 (Tier 3), $97 (Tier 4), and 33% (Tier 5).

WellCare Advance – $0 deductible with maximum out-of-pocket expenses of $4,500. Inpatient hospital copay is $325 for first five days. Outpatient hospital copay is $0-$100 per visit. Office visit copays are $5 and $35, while the Urgent Care and ER copays are $35 and $80. Diagnostic tests, procedures, outpatient x-rays, and lab tests have a $0-$150 copay. Outpatient mental health therapy visits are subject to $40 copay (group and individual). Dental, hearing, and vision exams are covered, subject to policy limits. No prescription drug benefits are included.

WellCare Dividend – $0 deductible with maximum out-of-pocket expenses of $6,700. Inpatient hospital copay is $1,450 per stay. Outpatient hospital copay is $350. Office visit copays are $10 and $50, while the Urgent Care and ER copays are $35 and $80. Diagnostic tests, procedures, outpatient x-rays, and lab tests have a $0-$50 copay. Outpatient mental health therapy visits are subject to $40 copay (group and individual). Dental, hearing, and vision exams are covered, subject to policy limits. 30-day prescription drug cost-sharing copays are $6 (Tier 1), $24 (Tier 2), $47 (Tier 3), $99 (Tier 4), and 33% (Tier 5).

Tennessee Prescription Drug (Part D) Plans And Monthly Rates

AARP Medicare Rx Walgreens from UHC – $59.60 per month. $410 deductible with 3,253 available formulary drugs. 30-day cost sharing copays at preferred pharmacies are $2 (Tier 1), $8 (Tier 2), $40 (Tier 3), 50% (Tier 4), and 27% (Tier 5). 90-day cost sharing copays at preferred pharmacies are $6 (Tier 1), $24 (Tier 2), $120 (Tier 3), 50% (Tier 4), and n/a (Tier 5). 4,478 members enrolled in the state.

AARP Medicare Rx Basic from UHC – $35.60 per month. $545 deductible with 3,009 available formulary drugs. 30-day cost sharing copays at preferred pharmacies are $2(Tier 1), $8 (Tier 2), 15% (Tier 3), 42% (Tier 4), and 25% (Tier 5). 90-day cost sharing copays at preferred pharmacies are $6 (Tier 1), $24 (Tier 2), 15% (Tier 3), 42% (Tier 4), and n/a (Tier 5). 7,354 members enrolled in the state.

AARP Medicare Rx Preferred from UHC – $102.30 per month. $0 deductible with 3,622 available formulary drugs. 30-day cost sharing copays at preferred pharmacies are $7 (Tier 1), $12 (Tier 2), $47 (Tier 3), 40% (Tier 4), and 33% (Tier 5). 90-day cost sharing copays at preferred pharmacies are $21 (Tier 1), $36 (Tier 2), $141 (Tier 3), 40% (Tier 4), and n/a (Tier 5). 8,716 members enrolled in the state.

BlueRx Essential– $52.50 per month. $505 deductible. Standard cost sharing copays at preferred pharmacies are $0 (Tier 1), $12 (Tier 2), $47 (Tier 3), 50% (Tier 4), and 25% (Tier 5).

BlueRx Enhanced– $105.10 per month. $505 deductible. Standard cost sharing copays at preferred pharmacies are $9 (Tier 1), $15 (Tier 2), $47 (Tier 3), 43% (Tier 4), and 25% (Tier 5). Preferred cost sharing copays at preferred pharmacies are $2 (Tier 1), $8 (Tier 2), $40 (Tier 3), 38% (Tier 4), and 25% (Tier 5).

BlueRx Enhanced Plus – $152.30 per month. $0 deductible. Standard cost sharing copays at preferred pharmacies are $9 (Tier 1), $17 (Tier 2), $47 (Tier 3), 41% (Tier 4), and 33% (Tier 5). Preferred cost sharing copays at preferred pharmacies are $2 (Tier 1), $10 (Tier 2), $40 (Tier 3), 36% (Tier 4), and 33% (Tier 5).

Cigna Extra Rx – $63.10 per month. $100 deductible with 3,342 available formulary drugs. 30-day cost sharing copays at preferred pharmacies are $4 (Tier 1), $10 (Tier 2), $45 (Tier 3), 50% (Tier 4), and 31% (Tier 5). 90-day cost sharing copays at preferred pharmacies are $12 (Tier 1), $30 (Tier 2), $135 (Tier 3), 50% (Tier 4), and n/a (Tier 5).

Cigna Secure Rx – $31.20 per month. $505 deductible with 3,162 available formulary drugs. 30-day cost sharing copays at preferred pharmacies are $1 (Tier 1), $5 (Tier 2), $24 (Tier 3), 50% (Tier 4), and 25% (Tier 5). 90-day cost sharing copays at preferred pharmacies are $3 (Tier 1), $15 (Tier 2), $72 (Tier 3), 50% (Tier 4), and n/a (Tier 5).

Cigna Saver Rx – $12.80 per month. $505 deductible with 3,289 available formulary drugs. 30-day cost sharing copays at preferred pharmacies are $0 (Tier 1), $10 (Tier 2), $40 (Tier 3), 50% (Tier 4), and 25% (Tier 5). 90-day cost sharing copays at preferred pharmacies are $0 (Tier 1), $30 (Tier 2), $120 (Tier 3), 50% (Tier 4), and n/a (Tier 5).

Farm Bureau Essential Rx – $88.40 per month. $480 deductible with 2,996 available formulary drugs. 30-day cost sharing copays at preferred pharmacies are $3 (Tier 1), $9 (Tier 2), $47 (Tier 3), 50% (Tier 4), and 25% (Tier 5). 90-day cost sharing copays at preferred pharmacies are $9 (Tier 1), $47 (Tier 2), $121 (Tier 3), 50% (Tier 4), and 25% (Tier 5).

Farm Bureau Select Rx – $100.20 per month. $0 deductible with 3,075 available formulary drugs. 30-day cost sharing copays at preferred pharmacies are $1 (Tier 1), $6 (Tier 2), $40 (Tier 3), 45% (Tier 4), and 33% (Tier 5). 90-day cost sharing copays at preferred pharmacies are $3 (Tier 1), $18 (Tier 2), $120 (Tier 3), 45% (Tier 4), and 33% (Tier 5).

Humana Walmart Value Rx – $22.70 per month. $480 deductible with 3,252 available formulary drugs. 30-day cost sharing copays at preferred pharmacies are $1 (Tier 1), $4 (Tier 2), 16% (Tier 3), 40% (Tier 4), and 25% (Tier 5). 90-day cost sharing copays at preferred pharmacies are $3 (Tier 1), $12 (Tier 2), 16% (Tier 3), 40% (Tier 4), and n/a (Tier 5).

Humana Premier Rx – $74.90 per month. $480 deductible with 3,306 available formulary drugs. 30-day cost sharing copays at preferred pharmacies are $1 (Tier 1), $4 (Tier 2), $45 (Tier 3), 49% (Tier 4), and 25% (Tier 5). 90-day cost sharing copays at preferred pharmacies are $3 (Tier 1), $12 (Tier 2), $135 (Tier 3), 49% (Tier 4), and n/a (Tier 5).

Humana Basic Rx – $31.30 per month. $480 deductible with 3,145 available formulary drugs. 30-day cost sharing copays at preferred pharmacies are $0 (Tier 1), $1 (Tier 2), 19% (Tier 3), 39% (Tier 4), and 25% (Tier 5). 90-day cost sharing copays at preferred pharmacies are $0 (Tier 1), $3 (Tier 2), 19% (Tier 3), 39% (Tier 4), and n/a (Tier 5).

Mutual Of Omaha Rx Plus – $87.90 per month. $480 deductible with 2,995 available formulary drugs. 30-day cost sharing copays at preferred pharmacies are $1 (Tier 1), $3 (Tier 2), 19% (Tier 3), 44% (Tier 4), and 25% (Tier 5). 90-day cost sharing copays at preferred pharmacies are $3 (Tier 1), $9 (Tier 2), 19% (Tier 3), n/a (Tier 4), and n/a (Tier 5).

Mutual Of Omaha Rx Premier – $35.90 per month. $480 deductible with 3,045 available formulary drugs. 30-day cost sharing copays at preferred pharmacies are $0 (Tier 1), $13 (Tier 2), 23% (Tier 3), 48% (Tier 4), and 25% (Tier 5). 90-day cost sharing copays at preferred pharmacies are $0 (Tier 1), $39 (Tier 2), 23% (Tier 3), n/a (Tier 4), and n/a (Tier 5).

Silver Script Choice – $28.60 per month. $350 deductible with 3,020 available formulary drugs. 30-day cost sharing copays at preferred pharmacies are $0 (Tier 1), $1 (Tier 2), $47 (Tier 3), 38% (Tier 4), and 26% (Tier 5). 90-day cost sharing copays at preferred pharmacies are $0 (Tier 1), $3 (Tier 2), $141 (Tier 3), 38% (Tier 4), and n/a (Tier 5).

Silver Script Plus – $69.80 per month. $0 deductible with 3,072 available formulary drugs. 30-day cost sharing copays at preferred pharmacies are $0 (Tier 1), $2 (Tier 2), $47 (Tier 3), 50% (Tier 4), and 33% (Tier 5). 90-day cost sharing copays at preferred pharmacies are $0 (Tier 1), $6 (Tier 2), $141 (Tier 3), 50% (Tier 4), and n/a (Tier 5).

WellCare Classic– $70.60 per month. $0 deductible with 3,100 available formulary drugs. 30-day cost sharing copays at preferred pharmacies are $0 (Tier 1), $1 (Tier 2), $35 (Tier 3), 42% (Tier 4), and 25% (Tier 5). 90-day cost sharing copays at preferred pharmacies are $0 (Tier 1), $3 (Tier 2), $105 (Tier 3), 42% (Tier 4), and n/a (Tier 5).

WellCare Extra– $30.30 per month. $405 deductible with 3,065 available formulary drugs. 30-day cost sharing copays at preferred pharmacies are $0 (Tier 1), $0 (Tier 2), $34 (Tier 3), 30% (Tier 4), and 33% (Tier 5). 90-day cost sharing copays at preferred pharmacies are $0 (Tier 1), $0 (Tier 2), $102 (Tier 3), 30% (Tier 4), and n/a (Tier 5).

WellCare Value Script– $15.50 per month. $415 deductible with 3,327 available formulary drugs. 30-day cost sharing copays at preferred pharmacies are $0 (Tier 1), $5 (Tier 2), $40 (Tier 3), 46% (Tier 4), and 25% (Tier 5). 90-day cost sharing copays at preferred pharmacies are $0 (Tier 1), $15 (Tier 2), $120 (Tier 3), 46% (Tier 4), and n/a (Tier 5).

Short-Term Plan Options (Under Age-65 Only)

Tennessee temporary health insurance rates are listed below. Prices are monthly for the state’s largest cities. Coverage is available statewide.

25-year-old male (Nashville)

$58 – $5,000 deductible with $1 million maximum benefits and 20% coinsurance. Policy underwritten by National General.

$68 – $5,000 deductible with $1 million maximum benefits and 50% coinsurance. Policy underwritten by Everest.

$78 – $2,500 deductible with $1 million maximum benefits and 50% coinsurance. Policy underwritten by Everest.

$94 – $1,000 deductible with $1 million maximum benefits and 50% coinsurance. Policy underwritten by Everest.

35-year-old female (Memphis)

$73 – $5,000 deductible with $1 million maximum benefits and 20% coinsurance. Policy underwritten by National General.

$86 – $5,000 deductible with $1 million maximum benefits and 50% coinsurance. Policy underwritten by Everest.

$99 – $2,500 deductible with $1 million maximum benefits and 50% coinsurance. Policy underwritten by Everest.

$121 – $1,000 deductible with $1 million maximum benefits and 50% coinsurance. Policy underwritten by Everest.

45-year-old male (Memphis)

$96 – $5,000 deductible with $1 million maximum benefits and 20% coinsurance. Policy underwritten by National General.

$120 – $5,000 deductible with $1 million maximum benefits and 20% coinsurance. Policy underwritten by Companion Life.

$158 – $2,500 deductible with $1 million maximum benefits and 20% coinsurance. Policy underwritten by National General.

$273 – $1,000 deductible with $1 million maximum benefits and 50% coinsurance. Policy underwritten by Everest.

55-year-old female (Knoxville)

$149 – $5,000 deductible with $1 million maximum benefits and 20% coinsurance. Policy underwritten by National General.

$173 – $5,000 deductible with $1 million maximum benefits and 20% coinsurance. Policy underwritten by Companion Life.

$241 – $2,500 deductible with $2 million maximum benefits and 30% coinsurance. Policy underwritten by UnitedHealthcare.

$441 – $1,000 deductible with $1 million maximum benefits and 50% coinsurance. Policy underwritten by Everest.

Additional Information:

BlueCross BlueShield dominated the state marketplace, writing almost 90% of all new applications submitted during Open Enrollment this year. That trend will likely continue in 2015 since their relationship with many local hospitals continues to keep prices low. Cigna, a large national carrier, is the only company that is likely to squeeze some of the BCBS market share away. Most applicants will continue to qualify for federal subsidies.

Kaiser Foundation (a reputable and trusted resource) predicts that Tennessee prices will again be among the lowest of any states for 2015 plans. Although Nashville premiums are expected to rise about 9%, the “narrow network” concept (smaller number of network doctors and hospitals) keeps most of the state stable.

BlueCross Blue Shield, however, may increase 2015 rates as much as 15%-20% because of a sicker-than-expected population that led to higher claims. The TN. Department of Insurance has accepted the proposed price hike.

The NCQA has once again awarded CIGNA as having the best HMO and PPO plans in the state. The ratings are determined by customer surveys surveys conducted by professional organizations such as CAHPS (Consumer Assessment of Healthcare Providers and Systems.

More than $1 million is being spent by the federal government to help Tennessee consumers purchase medical coverage during Open Enrollment. There is, however, a big problem. Seedco, the recipient of the money, has been sued in the past by…Are you ready for this? The federal government!

But there were other problems with Seedco. In 2013, the Tennessee Comptrollers office reported that almost $30,000 of fictitious claims were paid to a company that did not perform the work they stated. Workers routinely did never showed up at their place of employment.

This situation illustrates why experienced brokers or reputable websites are the most reliable resources for assisting consumers with their TN healthcare needs.

A special legislative session in February will attempt to provide a Medicaid-alternative to about 200,000 residents of the state. Governor Bill Haslam is hoping that “Insure Tennessee” will be widely accepted because of its emphasis on preventive treatment, no extra cost to consumers, and rewarding of personal responsibility and wise choices. Until after 2016, the federal government will pay for the entire cost of the program.

Two plans have emerged from the Medicaid-alternative discussions. “Healthy Incentives” and “Volunteer” are the tiers of benefits to be offered.

“Healthy Incentives” will be offered to consumers who do not have an option to purchase coverage through an employer. It closely resembles the TennCare option or individual coverage you can buy from the major carriers. Premiums are typically $20 per month if your income falls between 100% and 138% of the Federal Poverty Level guidelines. Households that earn under $10,000 per yer will benefit the most.

The “Volunteer” plan mandates that companies must pay at least 50% of their employee’s premiums. The balance will be paid by “vouchers, although the specifics have not yet been determined. It’s expected that the vouchers would pay most or all of the group plan costs.

BlueCross BlueShield of Tennessee has requested an average increase of 36% for its 2016 Marketplace plans. Humana has requested a 15.8% increase while Cigna is only asking for a .4% rate hike. Community Health Alliance offered some of the least expensive options in 2015, but they have requested a whopping 32.6% increase. Some of their policies could rise by as much as 65%.

Due to excessive enrollment, Community Health Alliance stopped offering new policies in mid-January. Many other co-ops across the country suffered unexpected financial losses because of the uncertainty of projected claims. Insurance Commissioner Julie Mix McPeak stated that although rate increases will be allowed, they will unlikely be as much as the carriers are requesting. NOTE: last year, TN medical premiums were among the lowest in the US.

Community Heath Alliance promptly ceased offering 2015 Exchange policies in January after fearing that too many enrollments would impact its ability to pay all claims. Rates were cheap and the number of applicants was much higher than anticipated.

However, it now appears that despite a proposed rate increase of more than 32%, there is a chance that new 2016 plans will not be available. The price hike was formally requested two months ago, but the TN Insurance Department is concerned that the increase may not be enough to sustain a proper business model. The deadline for approving rate changes is the end of August.

No more grandfathered plans from BlueCross BlueShield of Tennessee. Previously, policies issued before March 23, 2010 could be kept, despite not offering 10 required “essential health benefits” or meeting other ACA Legislation guidelines. President Obama, of course, also proclaimed that consumers could “keep their policies.”

These types of plans, while quite affordable, typically don’t include maternity benefits and place a deductible on preventative coverage. Also, mental illness and depression treatment is often limited or excluded. However, many residents preferred keeping these policies since they were customized to fit within their budget.

BCBST has notified policyholders that as of December 31, the policies will end, and new coverage must be selected. About 25,000 people are impacted and will need to choose alternative Marketplace contracts.